M&A as an opportunity for tax technology

Significant corporate changes like mergers, acquisitions, or asset purchases always bring uncertainty — but they also present a unique opportunity. For tax teams, M&A activity is often the perfect time — even an urgent imperative — to evaluate processes, systems, and overall readiness for the future.

M&A as a model for systems evaluation

The M&A process itself offers a strong framework for systems evaluation. During due diligence, companies map their current state and envision their future state, identifying gaps across systems, processes, and personnel. This process then informs the integration plan, which addresses how to align IT systems and workflows between the two organizations to ensure compatibility, efficiency, and business continuity.

Often, this plan calls for modernization or replacement of outdated systems — not just in core operations like finance and HR, but in tax as well.

When M&A reveals tax technology gaps

At Lucasys, we’ve seen firsthand how M&A shines a spotlight on tax system vulnerabilities, such as:

Reliance on complex Excel workbooks for critical tax calculations instead of using purpose-built software. Growth through acquisition can make manual processes unsustainable and risk-prone.

Acquisitions that introduce new regulatory complexity, such as a non-regulated company acquiring a regulated utility business.

Rapid, expensive growth with limited staffing and legacy systems unable to keep pace.

In all these cases, major organizational change acts as a catalyst to upgrade or replace outdated tax systems. But not all solutions are created equal.

What to look for in tax software during M&A

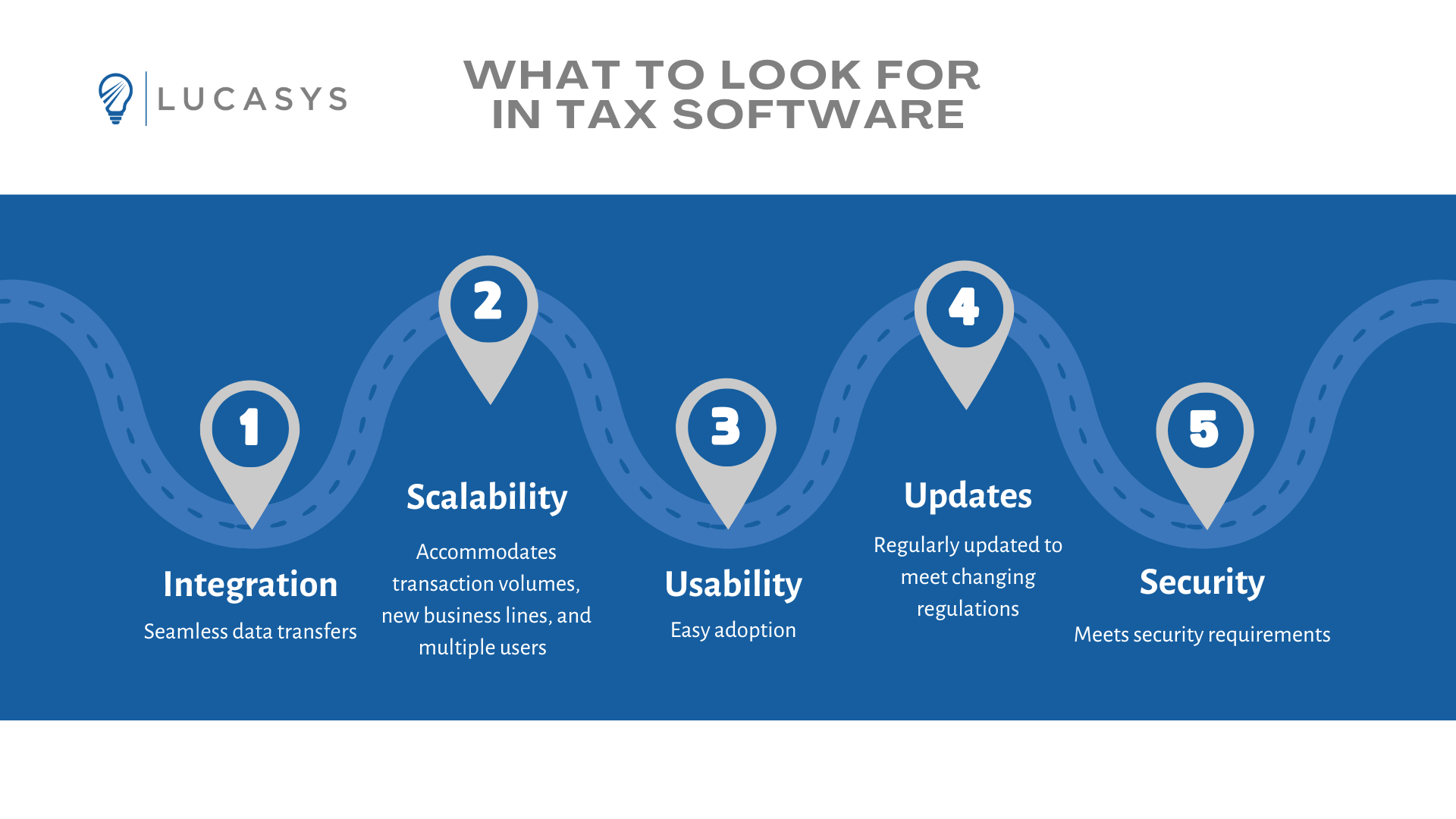

When evaluating new tax technology, companies should prioritize solutions with these characteristics:

Integration: Source data should transfer into tax systems seamlessly, with minimal manual intervention.

Scalability: The solution must accommodate growing transaction volumes, new business lines, and multiple users.

Usability: Employees should be able to adopt the system quickly, with a straightforward learning curve.

Updating: Given how frequently tax laws change, the software should be regularly updated to stay compliant.

Security: Whether cloud-based, in-house, or hybrid, the platform should meet current security requirements — and offer flexibility if preferences change.

How Lucasys delivers for growing companies

Lucasys Tax is built with these realities in mind.

Effortless Data Integration: With no complex mappings or heavy configurations required, users can easily import large and complex datasets from multiple sources — and export seamlessly into provision systems. It's essentially a plug-and-play approach.

Easy Adoption: Our intuitive interface and user-friendly functionality empower even new or less experienced team members to access powerful tools with minimal training.

Modular Growth: Thanks to our modular architecture, companies can start small and expand over time, choosing the functionality they need today and adding more as their needs evolve.

Flexible Deployment: Lucasys offers options for cloud-based, in-house, or hybrid implementations, allowing organizations to pivot as their IT strategies evolve.

Change is inevitable – but with the right technology, change becomes an opportunity.

If your organization is facing M&A or growth transitions, now may be the perfect time to modernize your tax technology foundation.

How Lucasys can help

Developing secure, scalable software for rate-regulated utilities is no small task. It requires a deep understanding of the regulatory landscape, the unique operational challenges of the industry, and a commitment to building systems that are not only secure and compliant but also flexible enough to grow with the organization.

At Lucasys, we’ve made it our mission to provide software solutions that meet these needs head-on. By leveraging the best practices outlined above, we’re helping utilities optimize their operations, safeguard their data, and ensure they are well-prepared for the future. Whether you're looking to scale your operations or enhance your security posture, building the right foundation is key to long-term success.

Learn more about Lucasys Solutions by visiting our website https://www.lucasys.com/solutions.