Lucasys Blog

The AI Power Problem: Why the Future of Technology Depends on the Energy Grid

Yesterday’s news signaled something important: the technology industry is beginning to confront the energy reality of artificial intelligence.

Recent IRS Notice 2026-7: Impacts on Corporate Alternative Minimum Tax for Investor-Owned Utilities

In a significant development for corporate taxpayers, the IRS has released Notice 2026-7, providing additional interim guidance on the application of the Corporate Alternative Minimum Tax (CAMT). This guidance is particularly relevant for investor-owned utilities that are subject to the CAMT due to their financial statement income exceeding $1 billion.

2025 Wrapped: Raising the Bar for Industry Software

As 2025 comes to a close, we’re taking a moment to reflect on a year of meaningful progress at Lucasys. This year was about more than growth metrics or feature releases; it was about building smarter, faster, and more reliable tools for the tax and industry professionals who rely on us every day.

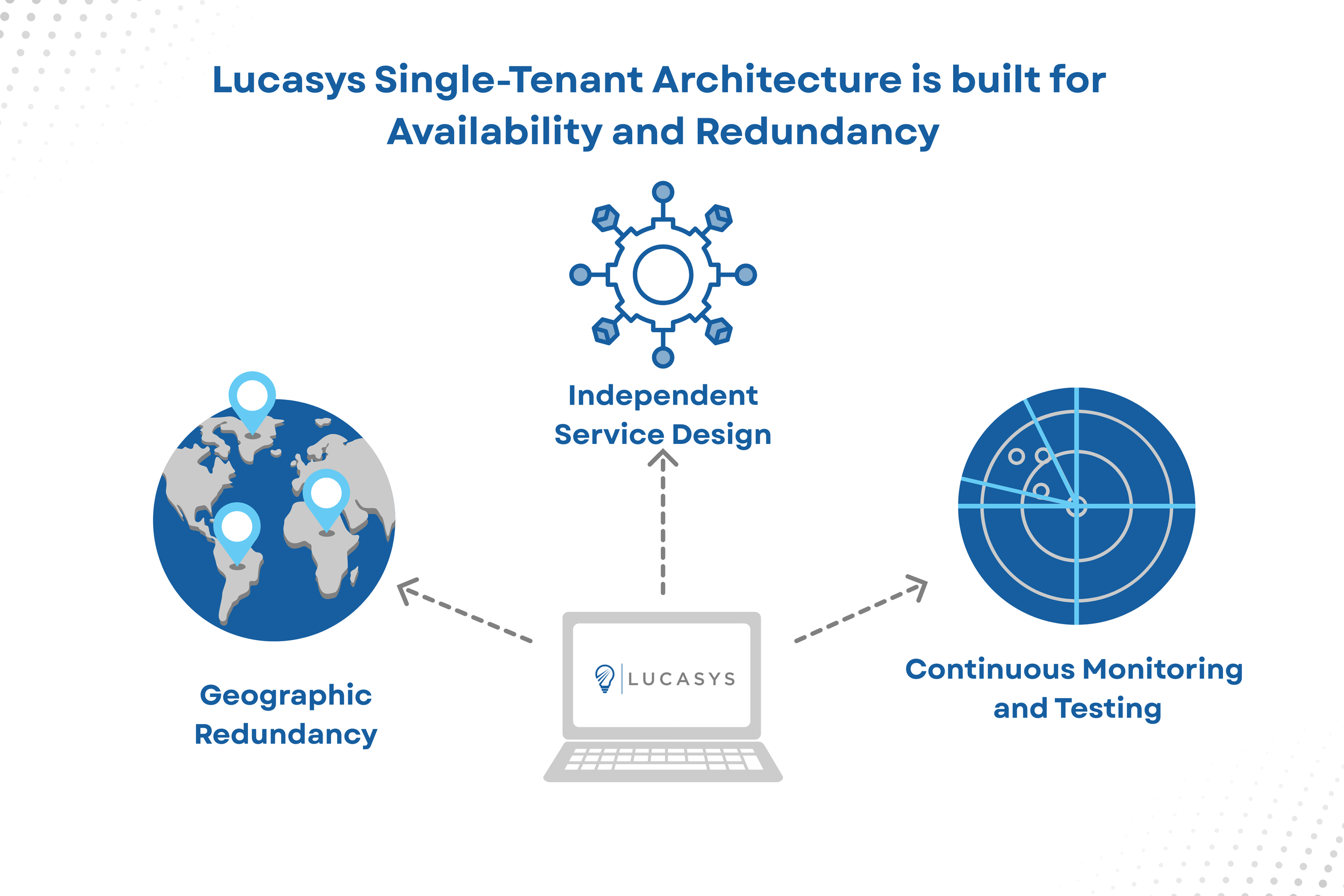

Navigating Cloud Outages: Lucasys' Resilient Architecture Shines Amid Recent AWS Disruptions

In today's hyper-connected world, cloud reliability isn't just a nice-to-have—it's essential for businesses, especially in regulated industries like utilities and energy. The recent global AWS outage on October 20, 2025, serves as a stark reminder of this reality. Triggered by DNS issues affecting DynamoDB in the US-EAST-1 region, the disruption caused widespread downtime for major platforms, including Amazon's own services, Snapchat, Roblox, Fortnite, banks, airlines, and delivery apps.

EEI Projects Record $208 Billion in Utility Investments for 2025: Why Tax Strategy is Key for Investor-Owned Utilities

Last week, the Edison Electric Institute (EEI) released compelling new data highlighting the massive capital expenditures planned by America's investor-owned electric companies for 2025. According to the report, these companies are projected to invest nearly $208 billion to enhance the nation's energy grid—making it smarter, stronger, more efficient, and more secure.

Lucasys Recognized Again on Inc. 5000 List of America’s Fastest-Growing Private Companies

Inc. revealed today that Lucasys, the leading provider of tax technology and technology-enabled services for regulated utilities, is named to Inc 5000.

Navigating “One Big Beautiful Bill” (OBBB): How Lucasys Keeps You Ahead

On July 4, 2025, President Trump signed into law the highly anticipated One Big Beautiful Bill (OBBB), bringing sweeping changes to tax law and major updates to depreciation and business interest expense provisions. As tax and finance teams across the country begin digesting these new requirements, one thing is clear: the ability to adapt quickly is more important than ever.

Lucasys Achieves SOC 1 Type II Certification: Reinforcing Trust, Transparency, and Financial Integrity

We’re excited to share that Lucasys has successfully completed its SOC 1 Type II certification—a significant milestone that highlights our unwavering commitment to security, control, and financial accuracy for our customers. At Lucasys, we understand the responsibility that comes with delivering software and services that directly impact our customers’ financial reporting.

Lucasys Income Tax Suite Launches on SAP® Store

We’re excited to announce that Lucasys’ suite of tax applications is now available on the SAP® Store! This milestone follows our recent partnership within the SAP® PartnerEdge® Open Ecosystem, reflecting our commitment to delivering innovative, purpose-built solutions for rate-regulated utilities and asset-intensive businesses.

Lucasys Unveils Tax Provision, Expanding Income Tax Suite

Lucasys, the leading tax software and service provider for energy and utilities, announces the release of its Tax Provision software solution. Purpose-built to provide an easy-to-use experience for ASC 740 compliance while also addressing the complex needs of the utility industry, this next-generation solution streamlines tax processes, enhances accuracy, and ensures compliance with unparalleled efficiency.

Powering progress in an industry that powers lives

At Lucasys, we are deeply committed to serving North America’s utilities and energy companies, an industry that forms the backbone of modern life. The recent widespread power outage across Spain, Portugal, and parts of southern France on April 28, 2025, as reported by CNN, serves as a stark reminder of just how critical this sector is to communities, economies, and everyday existence.

M&A as an opportunity for tax technology

Significant corporate changes like mergers, acquisitions, or asset purchases always bring uncertainty — but they also present a unique opportunity. For tax teams, M&A activity is often the perfect time — even an urgent imperative — to evaluate processes, systems, and overall readiness for the future.

Lucasys completes SOC 2 Type II certification renewal

Lucasys, the premier provider of cloud-based software and services for rate-regulated utilities, announces the successful renewal of its SOC 2 Type II certification. This milestone underscores Lucasys’ unwavering commitment to data security, operational excellence, and delivering trusted financial solutions to North America’s utility and energy sectors.

One ID To Rule Them All

Consistency is critical when managing large volumes of data, especially in tax and financial systems. Yet, many systems fall short when it comes to maintaining asset numbers across different cases or reports. When an asset is copied to a new case or scenario, the assignment of a new ID disrupts data continuity, making comparisons difficult and unnecessarily time-consuming.

Results Right Away, with Dynamic Updating

In today’s fast-paced business environment, waiting for software to catch up to your work is more than just frustrating—it feels like stepping back into the last century. At Lucasys, we understand the importance of immediacy and efficiency, which is why we’ve made dynamic updating a mandatory feature in all our systems.

Once Is Enough

At Lucasys, we understand that your time is one of your most valuable resources. That’s why we’ve built our systems to ensure that the work you’ve done in prior periods is preserved—even as new data is added or processes are updated.

The Lucasys software is designed to seamlessly integrate new information, such as additional budget data or actuals for new months, without overwriting or losing prior period adjustments. Using Incremental and Merge import options, you can update your data while retaining all topside or manual adjustments from earlier periods.

Lucasys Welcomes 21st Customer as More Utilities Move to Lucasys Tax

Lucasys Inc, the leading provider of cloud tax software for North American utilities and energy companies, celebrates a milestone moment in business growth by signing its 21st customer. The 21 electric, gas, and water utilities who trust Lucasys to manage their tax fixed asset processes represent more than $600 billion of fixed assets. Utilities around the country are transitioning away from legacy tax software to Lucasys Tax, signaling a growing trend in the utility industry.

"You Have to Care That Much"

In 2016, I had the privilege of joining a Mount Everest expedition with US Expeditions and Explorations (USX), a 501(c)(3) veterans organization dedicated to raising awareness for soldiers and veterans battling the internal war of mental health and wellness. This mission was co-founded by Command Sergeant Major Todd Burnett, a man whose resilience and advocacy for military mental health are unparalleled. CSM Burnett holds the unenviable record of surviving 45 improvised explosive device (IED) attacks throughout his career, a testament to the relentless dangers faced by those who serve.

“Tell Me What You Want, What You Really Really Want”

At Lucasys, we know that the success of our software starts with the strength of our team. Our staff is made up of highly experienced, skilled professionals who bring both technical expertise and real-world industry insight to every project. This not only makes us a trusted partner for our customers but also drives the development of high-quality, user-friendly systems that meet the unique needs of tax departments.

It’s Your Data

At Lucasys, we believe that trust and transparency should be at the core of every client relationship—and that includes how we handle your data. In fact, we don’t see it as our data at all. It’s your data, and that principle is reflected in the very foundation of our software.