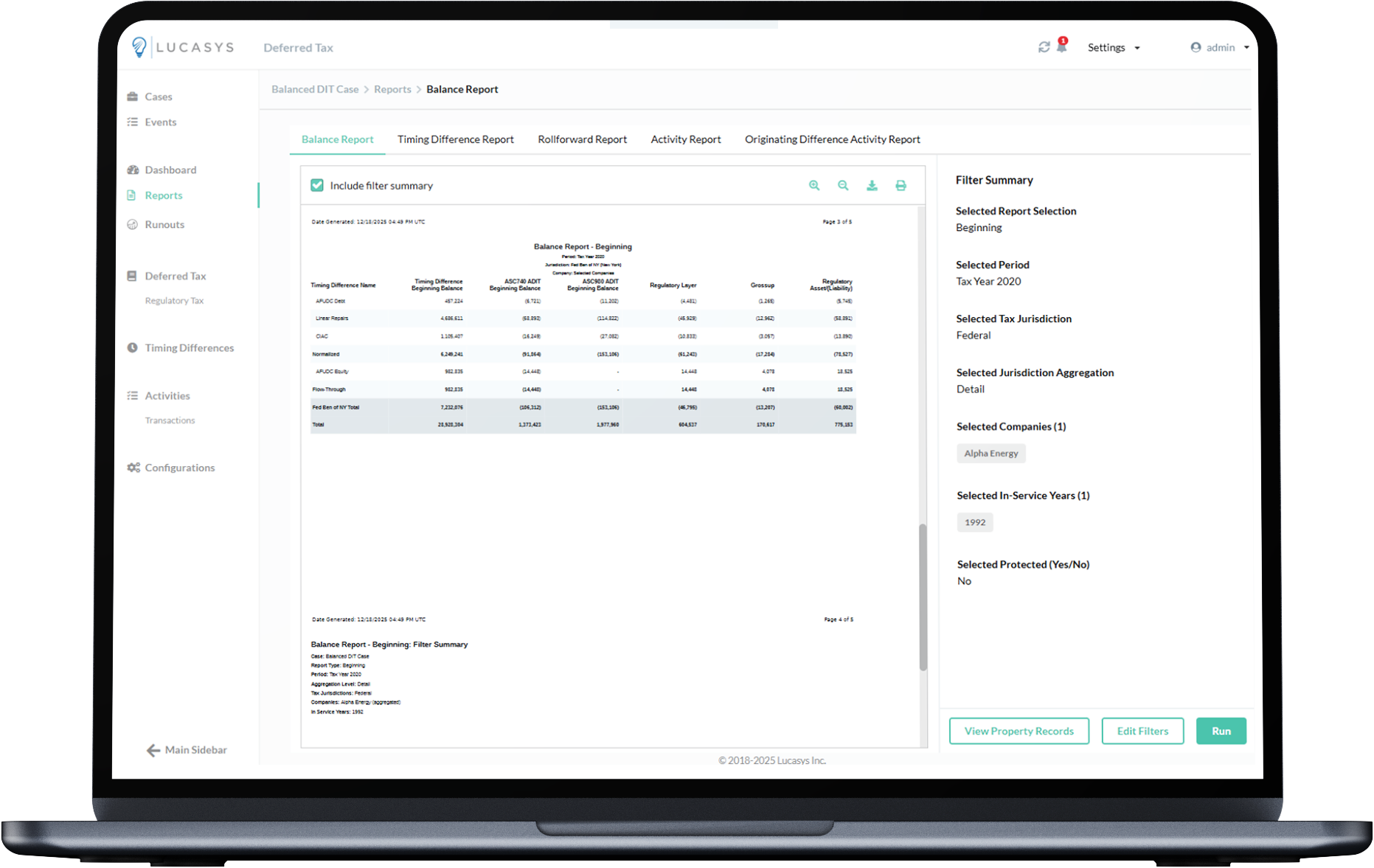

Deferred tax software solutions that simplify enterprise tax management

Automatically calculate, reconcile, and report deferred tax with confidence

Deferred tax solutions built for enterprise portfolios

When complexity outpaces the team…

Managing deferred tax across large asset portfolios is a constant race against time. Legacy systems alone can’t keep up with regulatory change, manual calculations invite errors, and disconnected data creates blind spots during every close.

Automated tax clarity

Lucasys Deferred Tax Solution automates the book-to-tax reconciliation process, from data ingestion and calculation to reconciliation and reporting – including the componentization and alignment of GAAP and tax bases.

Real-time tax confidence

And our team of industry experts who built the software is one phone call away. No more stressful audits, delayed reporting, and wasted hours chasing down inconsistencies. You get accurate, real-time results that integrate seamlessly with your existing ERP and financial systems, so your team can reclaim time for higher-value work.

Simplified setup, intuitive interface, expert support

Supported by our responsive in-house experts, launch faster with guided onboarding and a user-friendly interface, your team will actually enjoy using.

Built with industry in mind

Handle unique asset types, industry-specific tax rules, and regulatory requirements without custom coding or workarounds.

Seamless ERP integration

Connect directly to your financial systems for consistent, accurate data flow across accounting and tax workflows.

Enterprise-grade accuracy and audit readiness

Maintain compliance with built-in validation, version control, and detailed audit trails that simplify reviews and reporting.

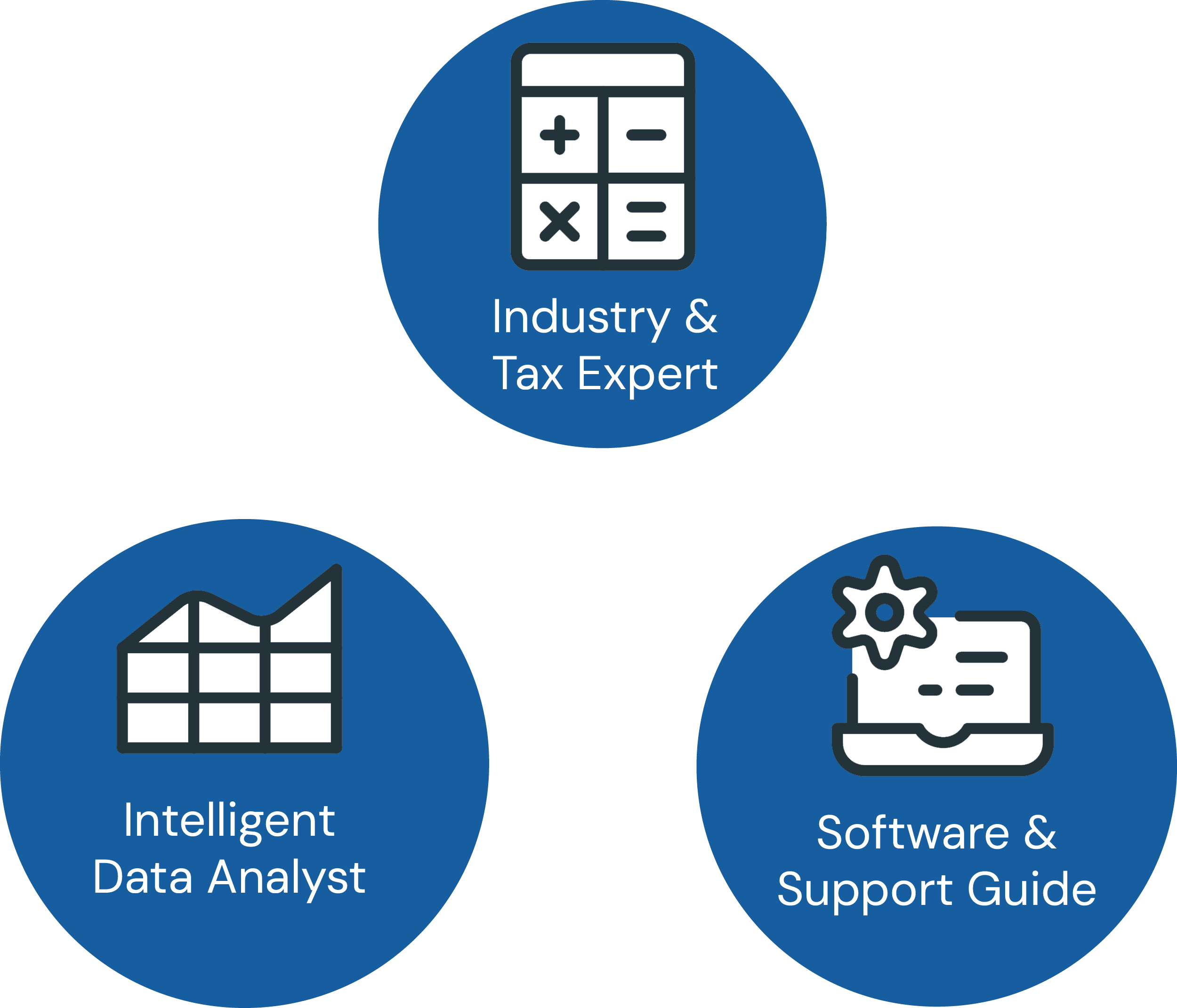

Lucasys AI

Lucasys AI is an embedded, interactive, agentic AI that empowers tax professionals to make faster, smarter decisions.

Think of your AI agents as 3 teammates with unique expertise:

Agent #1: an industry and tax expert

Agent #2: a software and support guide

Agent #3: an intelligent data analyst

Lucasys AI bridges the gap between information and action, allowing teams to find answers, analyze data, and automate workflows in seconds, all within a secure and compliant environment.

Companies that trust Lucasys

“The transition to Lucasys Tax has been instrumental in streamlining our tax fixed asset processes. The expertise and support provided by Lucasys have exceeded our expectations, positioning us for greater efficiency and effectiveness in our operations.”

Paul Schulte

Senior Tax Manager at Summit Utilities

See the ROI of automating deferred tax management

Teams using Lucasys report:

Up to 50% faster month-end close

Significant reduction in manual adjustments

Fewer audit findings and lower compliance costs

More time for tax planning and strategic analysis

Automation doesn’t just save time, it transforms the way enterprise tax teams operate.

Built for your industry

Lucasys delivers tailored solutions for:

Energy companies

managing large infrastructure and depreciation schedules

Utilities

with complex regulatory reporting and asset tracking

Oil & Gas enterprises

navigating multi-entity operations and tax complexity

Our platform is tailored to meet the unique accounting and compliance requirements of asset-intensive industries.