Lucasys Blog

Navigating the Age Wave: The Maturing Workforce in the Utility Industry

A significant trend has emerged in the utility landscape that demands attention and adaptation: the age of its workforce. The average age of employees in the industry consistently surpasses the national average. As veteran workers approach retirement, rate-regulated utilities are being prompted with both challenges and opportunities. As utilities confront their own business processes and explore the next generation of software solutions, Lucasys stands as an industry leader.

Simplified Implementation and Effortless Data Conversion

Implementing new software systems is a challenging task for rate-regulated utilities given the scope and complexity of their operations. The importance of seamless implementation and accurate data conversion cannot be overstated. Lucasys Depreciation was designed to address the unique challenges faced by rate-regulated utilities and provides an effortless implementation process.

Lucasys Depreciation Simplifies Fixed Asset Tracking for Utilities

Lucasys Depreciation was designed to streamline depreciation for utilities, with advanced reporting and dashboard functionality that make it easier for financial and tax teams to stay compliant while saving time and effort. Calculating and tracking fixed asset depreciation can be a complicated and time-consuming process, especially for rate-regulated utilities. Large quantities of assets and strict accounting regulations add complexity to what should be a straight-forward process. Whether you're a finance professional, tax professional, or someone interested in learning more about how technology can simplify complex financial processes, Lucasys Depreciation has the answers.

IRS Issues New Safe Harbor Rules for Natural Gas Repairs: What Rate-Regulated Utilities Need to Know

The IRS has issued a new revenue procedure, Rev. Proc. 2023-15, providing a safe harbor method of accounting for natural gas transmission and distribution property repairs, maintenance, replacements, and improvements. This new method allows taxpayers to classify these costs as either capital or deductible expenditures, providing clear and bright-line rules to reduce the burden of compliance.

Lucasys Deferred Tax Empowers Utilities with Dynamic Excess Reversal Controls

Lucasys Deferred Tax has modernized the management of deferred tax reversals by building a suite of intuitive and dynamic controls to streamline their management. Deferred tax balances and associated excess is tracked at a granular level to allow for complete calculation transparency, allowing for new insights into the accumulation and reversal of deferred balances.

Digital Technologies Propel Utilities to Transform Workforce

Utilities are bracing for a digital revolution, though according to a recent report most executives in the sector agree that their businesses are not prepared for it.

In the Digital Transformation and the Workforce Survey commissioned by EY Power & Utilities, nearly 90% of executives report having too few digitally savvy workers is frustrating their ability to adopt digital technologies. Not only is the problem of an insufficient workforce staring them in the face, by most of the respondents surveyed are lacking a plan on how to proceed. With near-universal agreement (94%) on the need for direct investment in technology and the workforce, utilities are soon to be left scrambling for solutions. The transformation of the power industry will be based on technology, but it will be driven by people.

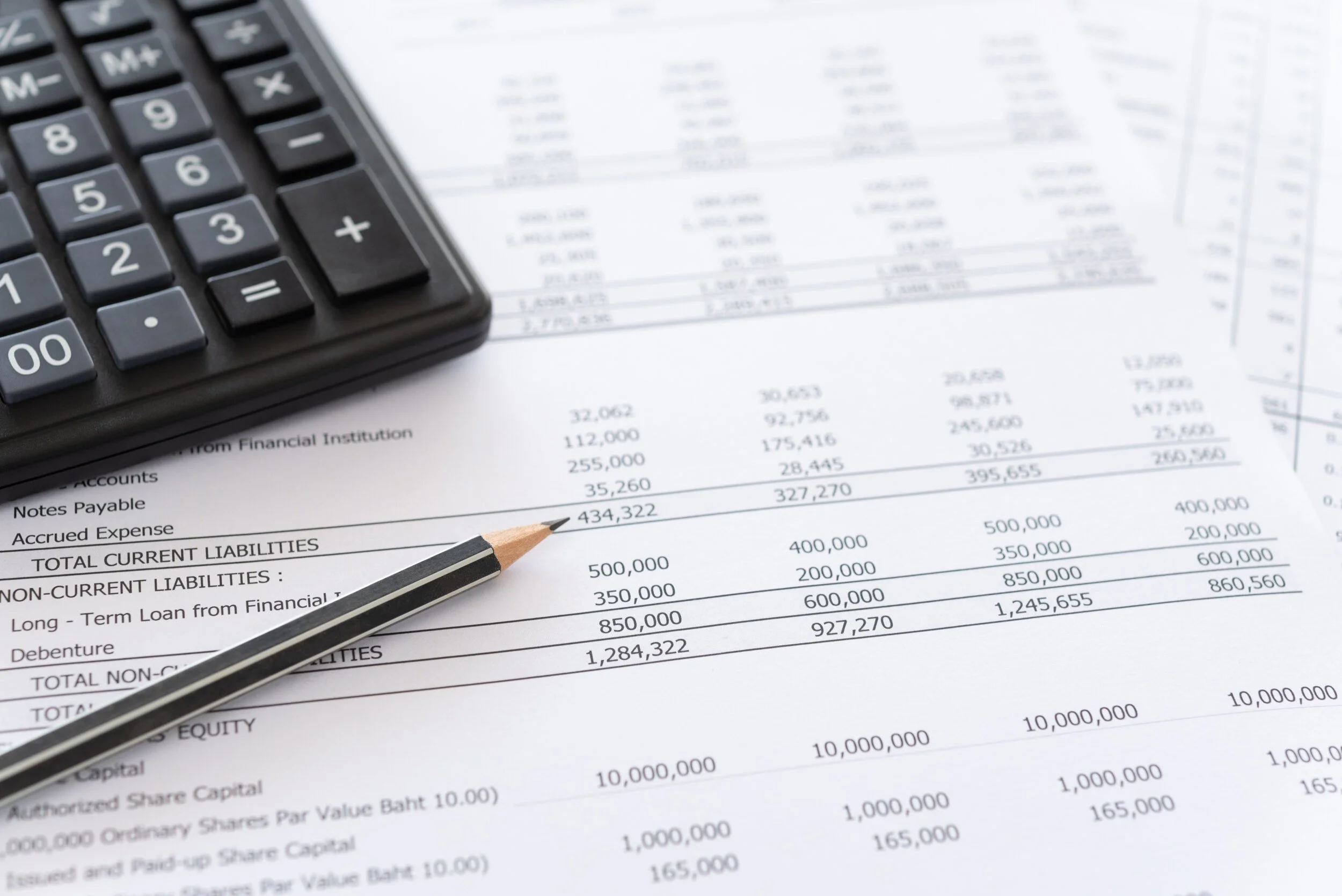

TBBS: an Increasingly Important Internal Control

Tax basis balance sheets (“TBBS”) are a foundational part of any tax department’s controls. While invaluable for supporting tax positions for financial reporting, without proper maintenance these critical workpapers can quickly develop inaccuracies. More and more utilities are finding that their tax basis balance sheet controls are insufficient, and without proper automation, this can lead to an immense and recurring manual effort for tax departments looking to preserve reliable tax accounting records.

What Is a kWh Anyway?

The average consumer notices their power consumption two times: when their lights go out and when they are paying their bill. The rest of the time, electric customers generally do not think about the role electricity plays in their day-to-day life or just how much electricity they use on any given day.

Part of the reason that power consumption is not thought about much is that it can be difficult to conceptualize, especially given some of the unique terminology. To help understand power consumption, the following infographics provide a comparative analysis of electricity use.

The Cost of Poor Software Design: A Cautionary Tale

If your business is using software with a poorly designed user interface, how much is it costing your bottom line? Perhaps a significant portion of your team’s hours are spent navigating confusing systems, time that would have otherwise been spent on productive projects. Perhaps your team is unable to navigate the systems themselves, necessitating the expense of external technical consultants. The multinational financial services group Citibank recently made an accidental payout of nearly $900M as a result of bad software design. How much do you stand to lose as a result of the usability of your software?

Expected Growth of US Water Infrastructure

The American Society of Civil Engineers (ASCE) recently gave the US a D grade for drinking water infrastructure and D+ for wastewater infrastructure. How can the richest nation in the world have infrastructure ranked so poorly on the world scale, and what investments are being made to improve our water networks?

Corporate Tax Rate Change Implications for Utilities

The 117th United States Congress is now set following two runoff elections in Georgia which have given the Democratic party control over 50 seats in the Senate and the tie-breaking vote through Vice President-elect Kamala Harris. With control of both chambers of Congress and the Presidency, Democrats are now poised to pursue more ambitious policy changes, including a proposed increase to the corporate tax rate.

Cost of Removal, Normalization, and Other Thorny Issues for Utilities

On August 14, 2020, the Internal Revenue Service (IRS) issued PLR 202033002 to address outstanding ruling requests on the application of the Section 168 normalization rules to cost of removal (COR). The IRS concluded that the net deferred tax liability (DTL) created by COR is not protected by the normalization rules but did not provide guidance on the actual implementation of the ruling’s conclusions.

Restoring a Culture of Data Quality

Data quality is not just an IT problem, it is a business problem. This may not be a pleasant realization for executives who have other things to think about and expect someone on their team to be taking care of such issues. But when your company is attempting to cultivate relationships with customers, shareholders, regulators, and auditors, and you cannot deliver on promises because your data does not back you up, your data problem is now everyone’s problem

Lucasys Announces Completion of SOC 2 Type 1 Audit Certification

Lucasys, a leading provider of cloud accounting, tax, and financial reporting solutions, today announced the completion of its SOC 2 Type 1 audit certification.

Utilities closely watching FERC ADIT reporting requirements

Comment letters are in, and the waiting game has begun.

On November 15, 2018, FERC initiated RM19-5, a Notice of Proposed Rulemaking that addresses how electric transmission providers, natural gas utilities, and pipelines must reflect the accounting and reporting of excess deferred income taxes resulting from the Tax Cuts and Jobs Act of 2017. Comment letters were due by January 22, 2019.

Tax Reform and ADIT

The Tax Cuts and Jobs Act, signed into law on December 22, 2017, has placed a responsibility on companies to understand the various complexities within the law and to assess the accounting and financial reporting impacts on their organizations. For rate-regulated utilities, certain changes in tax law have put a spotlight on the interplay of rate-making and accounting activities. In particular, the reduction of the top corporate income tax rate from 35% to 21% has initiated a cascade of activities for rate-regulated utilities.