The best enterprise tax software suite for energy and utilities

✓ Work with true industry experts

✓ See the logic behind every number

✓ Integrate without IT hassles

✓ Work with true industry experts ✓ See the logic behind every number ✓ Integrate without IT hassles

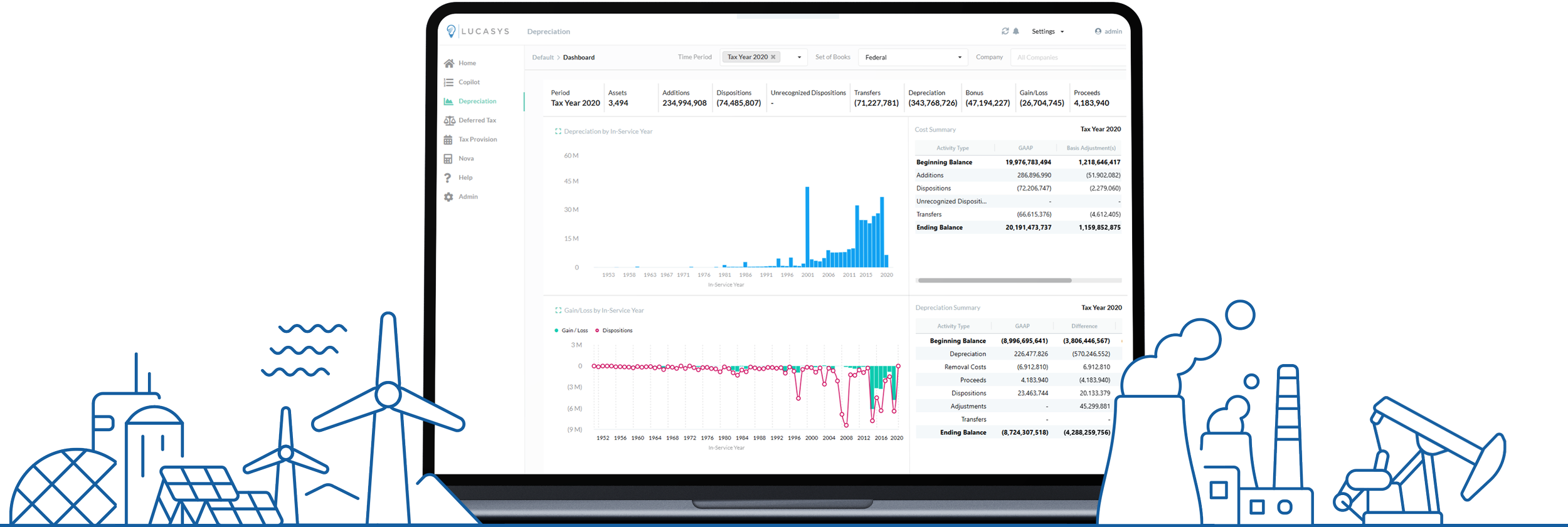

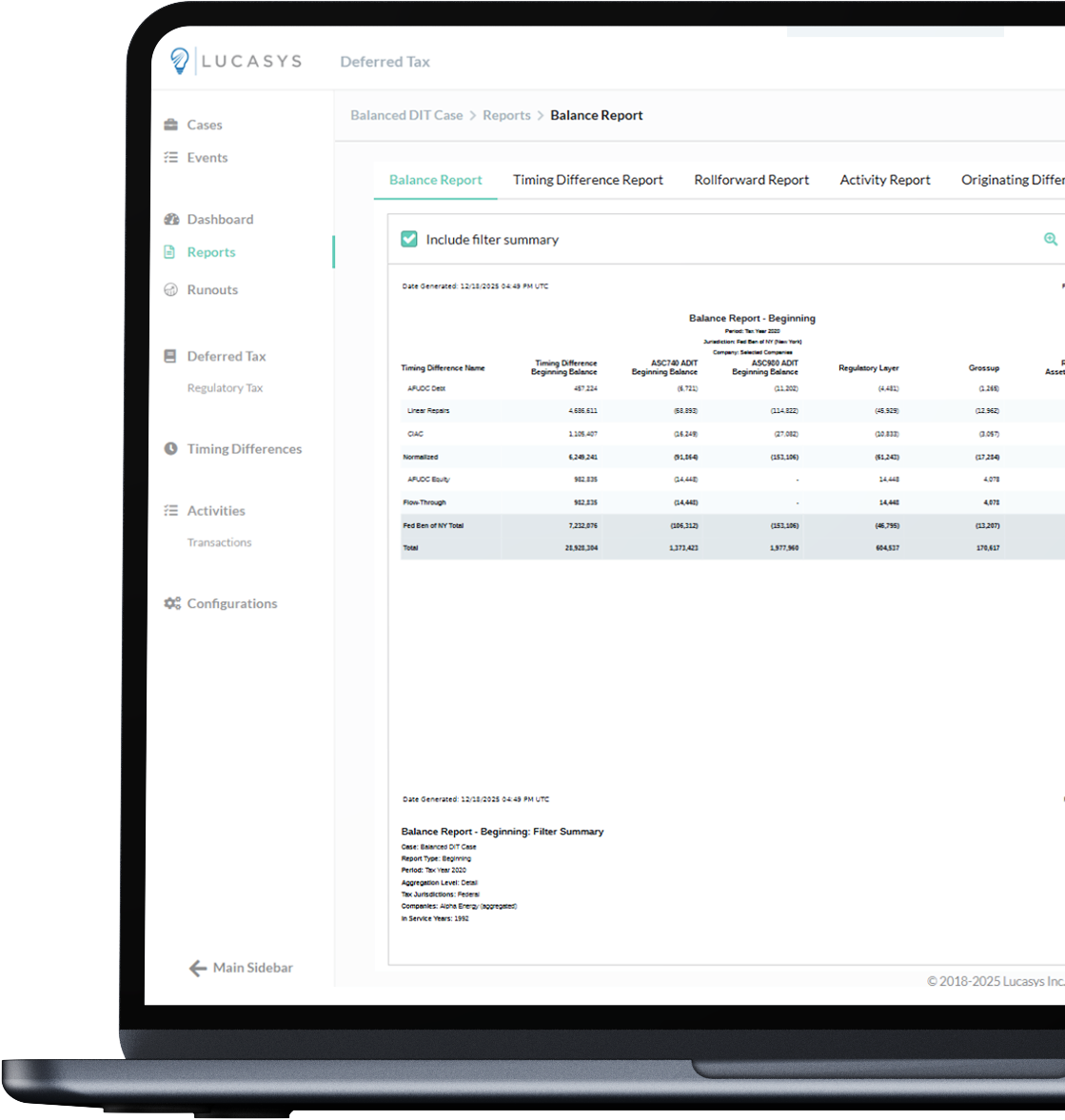

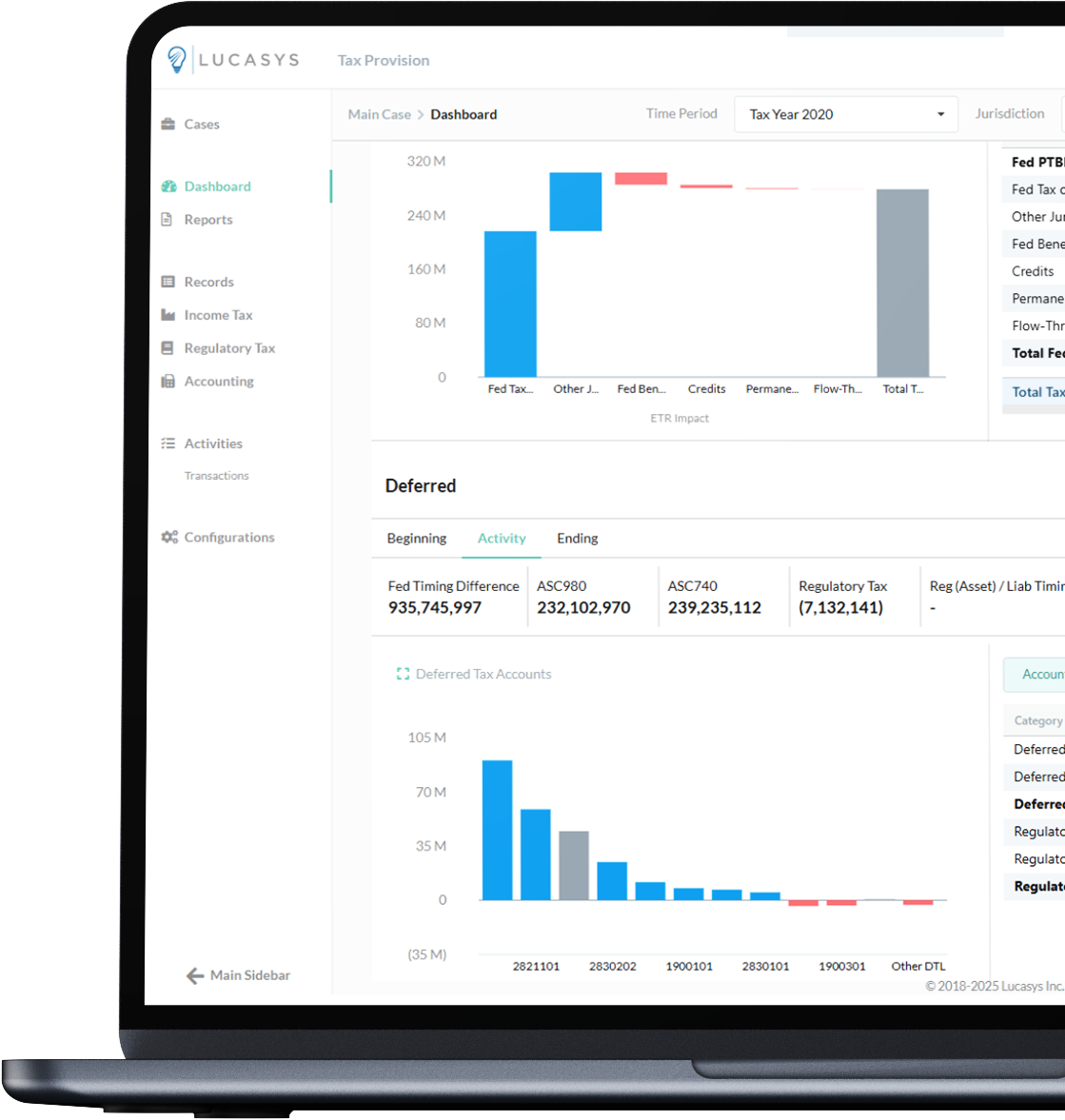

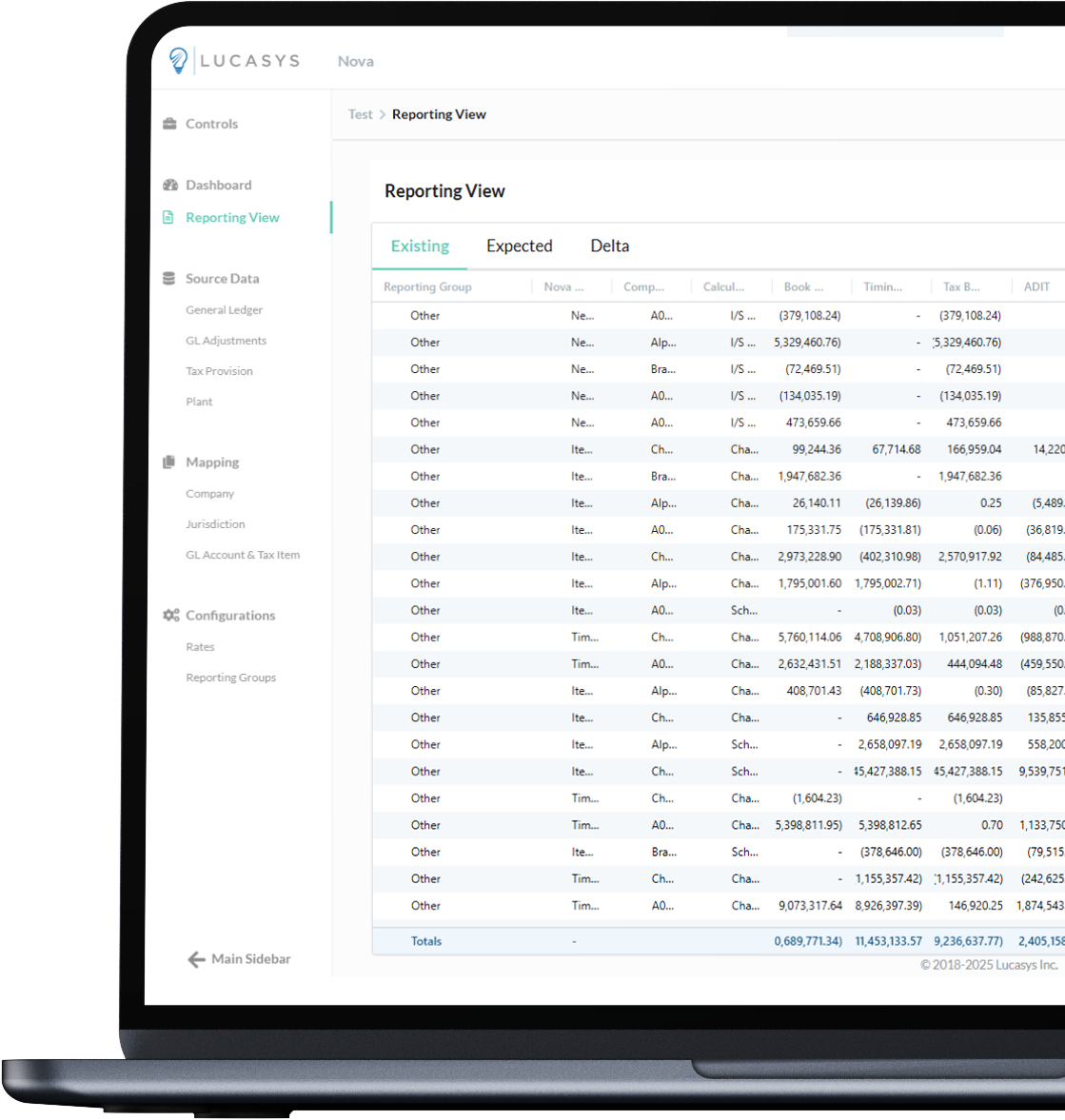

Going beyond traditional tax solutions

We understand that when you have a question, you need expert answers right away.

Our team of industry veterans can advise you on everything from legislation changes to capital planning and more.

So whether you have a software or an industry question—or both—Lucasys has your back.

Built for the way you work

A modern, transparent tax suite created for the unique challenges of asset-intensive industries.

With Lucasys, your first call is the right call

The first line of support is your implementation team. Experts fluent in utility operations, legislation and business context built the software and will answer your call.

No tiered ticket queues

Speak directly to the people who built the system and understand your industry.

Get answers grounded in industry insight

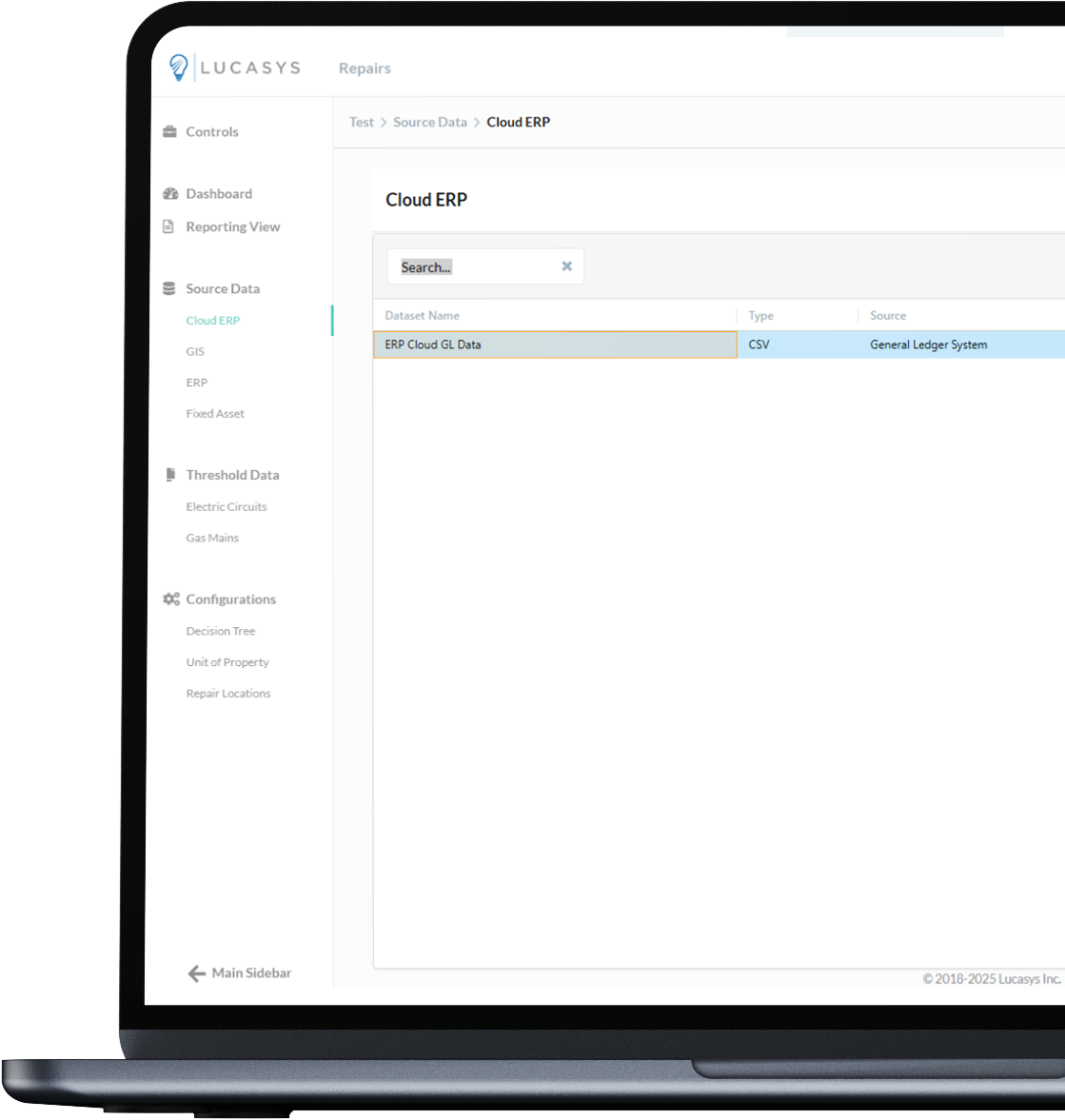

Designed to natively integrate with SAP, Oracle, and other enterprise systems, Lucasys causes minimal disruption.

Implementation that fits your infrastructure

With an average of 15 years of industry experience, each Lucasys team member understands your organization's biggest challenges.

Software solutions built for complexity

Finally, tax software that’s easy to use and easy to trust

Intuitive

experience

You can sign in on Day 1 and find what you need. No complicated training manual needed.

Self-service

design

Need to add another Lucasys application? Build a new integration? No problem. And no need to call IT.

Data & process transparency

No black box calculations means you can always find what you need down to the decimal.

Customer

support

Every call connects you to someone who knows your tax environment and can guide you quickly.

About Lucasys

We believe that when individuals are set up for success, the organization’s success becomes inevitable. Our software solutions are built to support that chain of impact. Every Lucasys solution is purpose-built with the user in mind, offering intuitive interfaces, self-service workflows, full data and process transparency, and responsive, expert-led support. We also share tools, resources, and knowledge to help teams continuously grow.