Lucasys Blog

Lucasys 2024 Wrapped: A Year of Growth and Connection

As we close the book on 2024, we’re celebrating an incredible year of achievements, milestones, and connections. We have expanded to 21 talented team members, served 19 customers, rolled out 1,187 product improvements, attended 9 industry events, delivered 34 in-person demos across the country, and consumed an immense amount of coffee. Our team’s dedication and collaboration made this year one for the books. Here’s to our customers, partners, and team for making 2024 a success—we can’t wait to see what’s ahead in 2025!

Hope Utilities Expands Use of Lucasys Solution with Deferred Tax Application

Hope Utilities, a leading provider of US natural gas and water distribution services, has built upon their previous success with Lucasys and expanded their use of the Lucasys Tax solution by implementing its Deferred Tax application. Building on the successful implementation of Lucasys for Tax Depreciation, this milestone in Hope Utilities’ technology integration is part of the company’s ongoing commitment to leveraging advanced technologies to optimize operational efficiency and accuracy in financial reporting.

What Utilities Can Learn from Macy’s Accounting Error

Macy’s recent disclosure of an employee’s intentional misreporting of up to $154 million in expenses has sparked important conversations about internal controls, accountability, and transparency. While the retail giant is navigating this challenge, there are key lessons for businesses across all industries, including utilities, where accurate financial reporting is not just critical but also highly scrutinized by regulators.

Preparing for Policy Shifts Under the Trump Administration: What Investor-Owned Utilities Should Do Now

As President-elect Trump prepares to return to the White House alongside a Republican-led Congress, investor-owned utilities (IOUs) are looking at a landscape ripe for transformation. From extensions of his 2017 tax cuts and potential new tariffs to increased focus on energy production, major policy changes that directly impact the utility sector are likely on the horizon. To stay resilient in this evolving environment, IOUs need to act now.

The Hidden Dangers of Bad Software Design: Why User Interface Matters More Than You Think

In an era where software powers almost every facet of modern life it can be easy to overlook the critical importance of user interface (UI) design. While sleek interfaces and easy navigation are often touted as the highlights of good design, poor UI can have far-reaching, sometimes disastrous consequences. Lucasys software is built to prevent these risks, offering clear, efficient, and error-proof interfaces. Below, we examine several real-world cases where inadequate UI design led to serious consequences and explain how Lucasys avoids similar pitfalls.

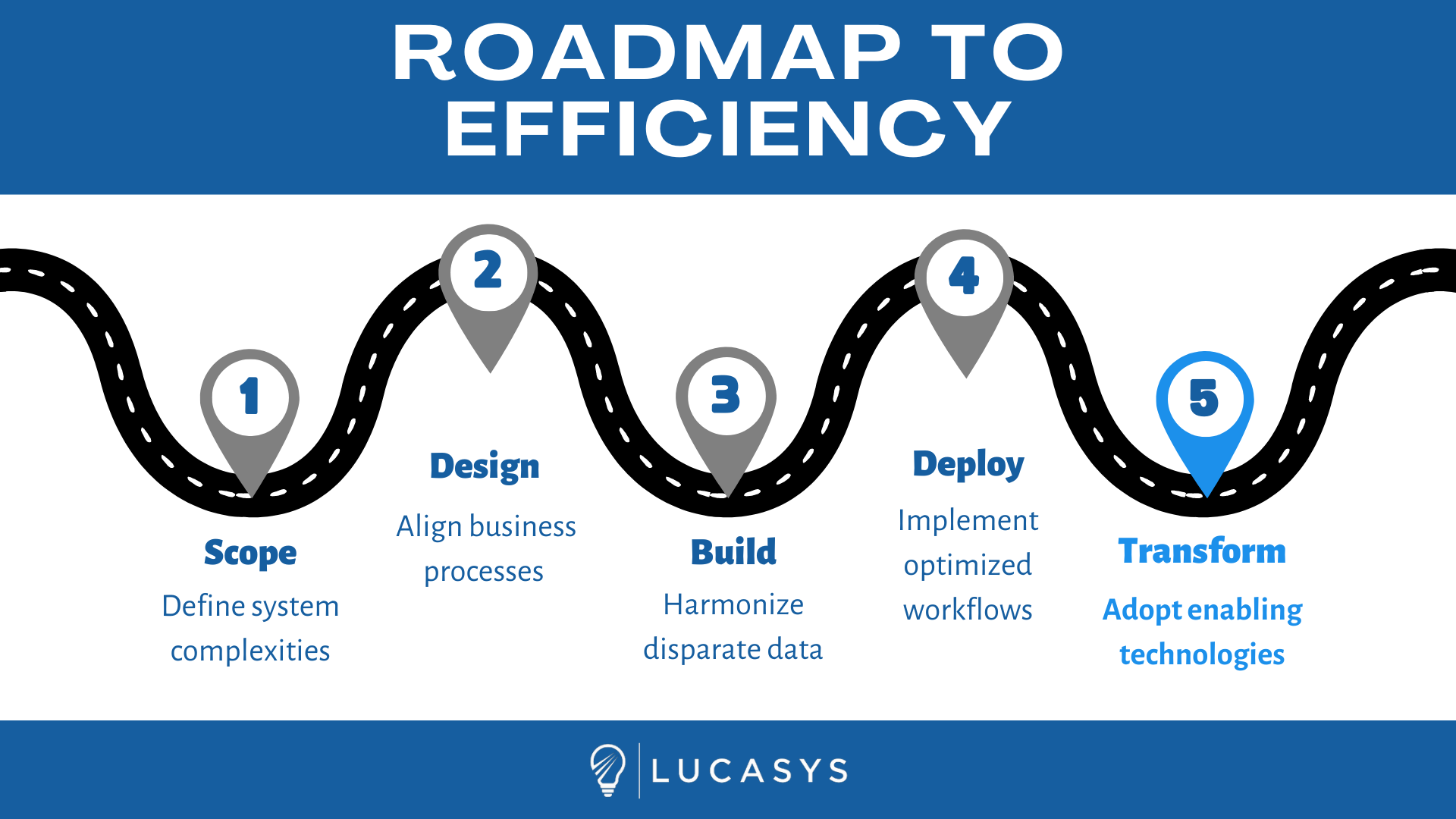

Enterprise-Level Tax Systems: Lessons Learned from 100+ Implementations

Over the course of my career, I’ve had the privilege of working with over 100 enterprise clients in the utility and energy sectors, implementing tax technology systems ranging from business process automation to fixed asset cost recovery and deferred taxes to tax provision solutions. At Lucasys, our goal is to empower the modern finance organization to become industry leaders in the use of tax technology, increasing efficiencies and reducing risk in tax compliance, accounting, forecasting, and regulatory processes. Lucasys provides a suite of integrated tax applications to meet the growing complexities and challenges of today’s business and regulatory climates.

The Future of Finance and Technology: How Utilities Can Lead the Digital Transformation

As utility companies face increasing pressures from regulatory demands, shifting energy landscapes, and evolving customer expectations, the importance of digital transformation has never been greater. The intersection of finance and technology is opening new avenues for operational efficiency, data-driven decision-making, and streamlined business processes. For utilities, which operate in complex, highly regulated environments, this presents a unique opportunity to lead the way in digital transformation while securing long-term growth and sustainability.

Strategy and the Role of Tax

I’m reading a book, Strategy That Works by Paul Leinwand and Cesare R. Mainardi ], because, of course, that’s what you do when you are semi-retired. As I read, I reflected on how strategy at most utility companies is directed at becoming more efficient and more effective operationally while finding a way to otherwise reduce costs to offset continuing customer rate pressure. The tax department’s role today generally has 2 components both related to cost savings: (1) deliver tax savings that lower tax expense for the company or tax costs recoverable in rates, and (2) deliver costs savings from operating more efficiently.

Mastering ASC 740: Best Practices for Utility Companies

ASC 740, or Accounting Standards Codification 740, governs how companies report income taxes in their financial statements. For utility companies, complying with ASC 740 presents unique challenges due to the industry's complex regulatory environment and the intricate nature of tax provisions, deferred taxes, and rate-regulated accounting practices. Mastering ASC 740 is essential for ensuring accurate financial reporting, mitigating risk, and satisfying both regulatory and audit requirements.

Preparing for Regulatory Scrutiny: Tax Compliance in the Utility Sector

In today’s rapidly evolving regulatory landscape, investor-owned utilities (IOUs) face increasing pressure to ensure their tax practices are not only compliant but also transparent and defensible. With the growing scrutiny from regulators and the ever-changing tax laws, staying ahead of potential audits is more critical than ever. To navigate these challenges, IOUs must implement robust strategies for tax compliance, leveraging advanced tools and technologies that can simplify the process and mitigate risks.

Understanding the Tax Implications of Mergers and Acquisitions in the Utility Sector

Mergers and acquisitions (M&A) have long been a strategic tool for growth and expansion in the utility industry. Whether to achieve economies of scale, expand service territories, or diversify energy portfolios, these transactions can significantly reshape a company's operations and market position. However, along with the potential benefits, M&A activities come with complex tax implications that can have a lasting impact on a company's financial health and regulatory compliance.

Navigating Tax Challenges in a Multi-Jurisdictional Utility Operation

For investor-owned utility companies operating across multiple states, managing tax compliance is a complex and often daunting task. Each state has its own set of tax laws, regulations, and reporting requirements, which can create a labyrinth of obligations for utility tax departments. In this environment, staying compliant while optimizing tax positions requires not only deep expertise but also the right tools and technology.

Lucasys Completes Two Phases in AEP’s Tax Technology Transformation, Building on Past Successes with Lucasys-led Solutions

Lucasys has successfully completed Phases 1 and 2 of American Electric Power’s (AEP) ongoing tax technology transformation initiative in partnership with Lucasys, a leading software and consulting firm specializing in the utility sector. These milestones mark significant progress in AEP’s journey toward modernizing and optimizing their tax function to manage the complexities of their dynamic operations.

Navigating the PowerTax End of Life: What Utilities Need to Know and How to Transition Smoothly to Lucasys Tax

As a utility company, you rely on robust, reliable software to manage complex tax processes efficiently. For decades, PowerPlan’s PowerTax software has been the only available industry-focused tax fixed asset solution. However, the Lucasys team has heard from many utilities that PowerPlan has communicated an End of Life for its PowerTax software. If your organization has been told that PowerTax is reaching its End of Life, you may now be facing the urgent task of finding a new solution to replace your legacy solution. The discontinuation of any software poses significant challenges, but it also presents an opportunity to upgrade to more advanced, future-proof technology like Lucasys Tax.

Strengthening Infrastructure for Resilience: The Crucial Role of Tax Software in Investor-Owned Utility Companies

As climate change accelerates, extreme weather events are becoming increasingly common, posing significant challenges to utility companies across the globe. Investor-owned utilities (IOUs), responsible for providing essential services to millions, are at the forefront of efforts to strengthen infrastructure and ensure resilience against these threats. While physical upgrades and operational strategies are crucial, one often-overlooked aspect of this resilience is the role of a utility’s tax division and its technology. Robust tax management is vital in funding, maintaining, and expanding resilient infrastructure.

Corporate Tax Rate Changes on the Horizon… Again! What Utilities Need to Know

As the 2024 election season gains momentum, regulated utilities are facing the prospect of significant policy shifts that could dramatically impact their financial landscapes. Vice President Kamala Harris has recently announced that if elected, she plans to raise the corporate tax rate to 28%. This proposal has raised alarms among tax leaders and CFOs within the utility sector, as the potential changes could lead to substantial adjustments in deferred tax liabilities.

Innovation in Tax Fixed Assets: Hope Utilities Adopts Best-in-Class Lucasys Software

Leading natural gas and water distribution services company, Hope Utilities, has implemented Lucasys’ industry-leading tax fixed asset software. Faced with the challenges of maintaining legacy software systems, Hope Utilities recognized the opportunity to streamline their accounting solutions and transform their business processes.

AEP's Data Revolution: Partnering with Lucasys to Prepare for the Next Leap in Tax Technology

American Electric Power (AEP), one of the nation’s largest utility power producers and operator of the nation’s largest electric transmission network, has a longstanding reputation as an industry leader in digital transformation and technological innovation. Successful operations have led AEP to sustained growth, expanding the organization into additional states and service territories while accumulating a blend of data, processes, and technologies.

Summit Utilities Partners with Lucasys to Streamline Tax Fixed Assets

In a pivotal move towards operational efficiency and advanced technology adoption, leading natural gas company Summit Utilities has embarked on a transformative endeavor with premier software and consulting firm Lucasys to revolutionize their tax fixed asset software.

Emerging Cybersecurity Threats: How Utilities Can Prepare

In today's increasingly interconnected world, the threat landscape for US utilities is evolving at an unprecedented pace. As these vital organizations continue to embrace digital technologies to improve efficiency and customer service, they also find themselves in the crosshairs of malicious actors seeking to exploit vulnerabilities. The realm of cybersecurity is fraught with challenges, and understanding the latest threats is essential for safeguarding critical infrastructure.