Lucasys Blog

Mastering ASC 740: Best Practices for Utility Companies

ASC 740, or Accounting Standards Codification 740, governs how companies report income taxes in their financial statements. For utility companies, complying with ASC 740 presents unique challenges due to the industry's complex regulatory environment and the intricate nature of tax provisions, deferred taxes, and rate-regulated accounting practices. Mastering ASC 740 is essential for ensuring accurate financial reporting, mitigating risk, and satisfying both regulatory and audit requirements.

Innovation in Tax Fixed Assets: Hope Utilities Adopts Best-in-Class Lucasys Software

Leading natural gas and water distribution services company, Hope Utilities, has implemented Lucasys’ industry-leading tax fixed asset software. Faced with the challenges of maintaining legacy software systems, Hope Utilities recognized the opportunity to streamline their accounting solutions and transform their business processes.

AEP's Data Revolution: Partnering with Lucasys to Prepare for the Next Leap in Tax Technology

American Electric Power (AEP), one of the nation’s largest utility power producers and operator of the nation’s largest electric transmission network, has a longstanding reputation as an industry leader in digital transformation and technological innovation. Successful operations have led AEP to sustained growth, expanding the organization into additional states and service territories while accumulating a blend of data, processes, and technologies.

Emerging Cybersecurity Threats: How Utilities Can Prepare

In today's increasingly interconnected world, the threat landscape for US utilities is evolving at an unprecedented pace. As these vital organizations continue to embrace digital technologies to improve efficiency and customer service, they also find themselves in the crosshairs of malicious actors seeking to exploit vulnerabilities. The realm of cybersecurity is fraught with challenges, and understanding the latest threats is essential for safeguarding critical infrastructure.

Corporate Tax Rate Changes Are on The Horizon: What Utilities Need to Know

As the landscape of corporate tax rates remains uncertain, one thing is crystal clear: utilities must be prepared to adapt swiftly when change inevitably arrives. The timing and specifics of these rate adjustments may be hazy, but one proactive step utilities can take is investing in modern tax software that offers flexibility and functionality. Adaptable tax software can empower tax departments to adjust their computations quickly and efficiently in response to evolving tax regulations, ensuring compliance and accurate financial reporting in a dynamic tax environment.

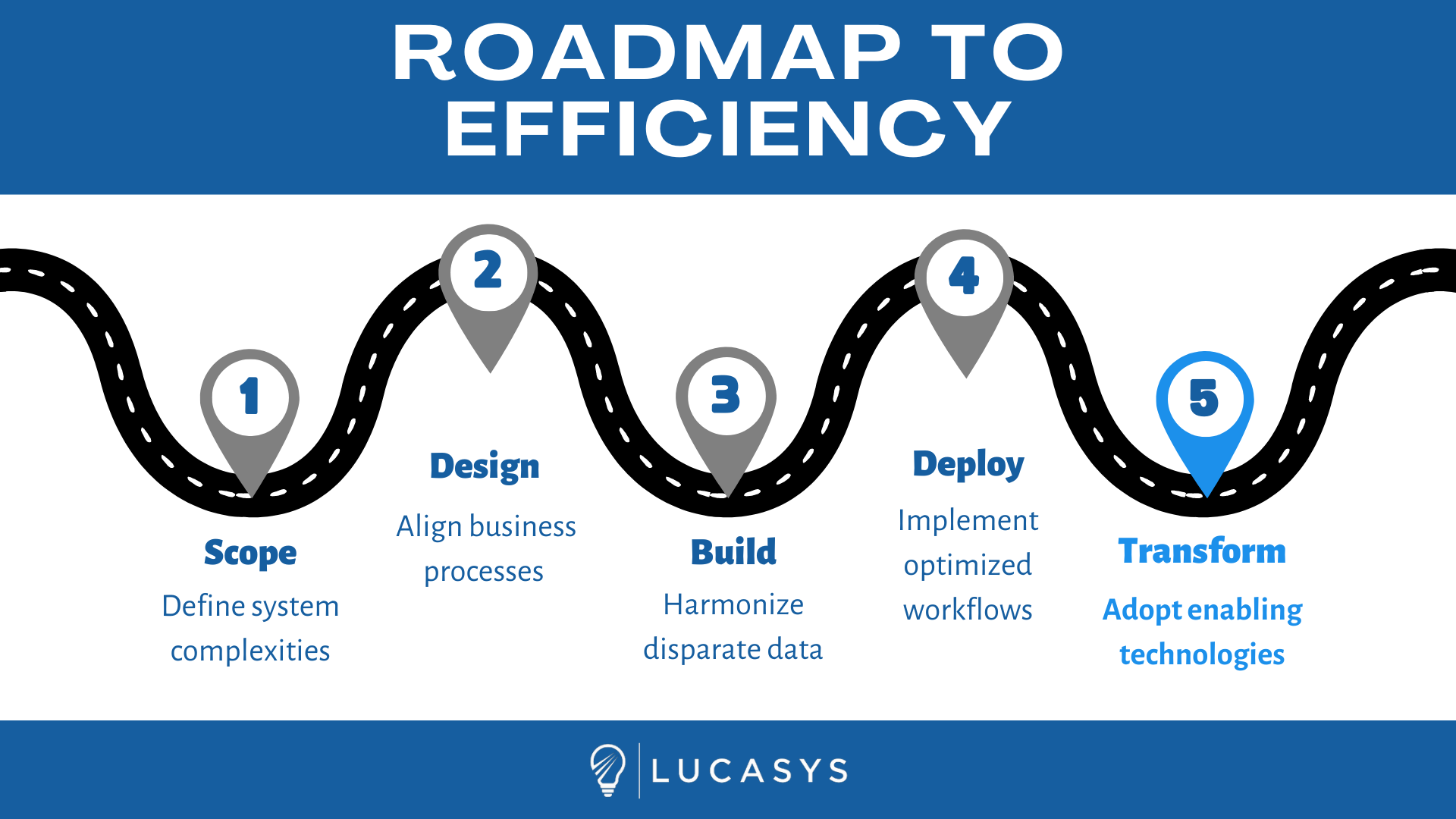

Empowering Modern Utilities: The Essential Investment in High-Performance Accounting Software

In an era where technological advancements are reshaping industries and redefining the very essence of efficiency, utilities find themselves at a crucial crossroads. Ever-growing demand for reliable energy services has placed an enormous burden on rate-regulated utilities to streamline their operations and optimize every facet of their business. However, many utilities continue to rely on outdated accounting systems and processes that limit their ability to adapt to an evolving landscape. Investment in high-performance computing is becoming critical for operational success, and utilities need a viable plan for transitioning to the best available accounting technology in order to drive sustainable growth in a competitive market.

Navigating the Age Wave: The Maturing Workforce in the Utility Industry

A significant trend has emerged in the utility landscape that demands attention and adaptation: the age of its workforce. The average age of employees in the industry consistently surpasses the national average. As veteran workers approach retirement, rate-regulated utilities are being prompted with both challenges and opportunities. As utilities confront their own business processes and explore the next generation of software solutions, Lucasys stands as an industry leader.

Simplified Implementation and Effortless Data Conversion

Implementing new software systems is a challenging task for rate-regulated utilities given the scope and complexity of their operations. The importance of seamless implementation and accurate data conversion cannot be overstated. Lucasys Depreciation was designed to address the unique challenges faced by rate-regulated utilities and provides an effortless implementation process.

Lucasys Depreciation Simplifies Fixed Assets with User-Friendly Controls

Depreciation tracking can be a challenging task for rate-regulated utilities that have to comply with strict accounting standards, so Lucasys Depreciation was specifically designed to make the process more intuitive and user-friendly. One of the key benefits of Lucasys Depreciation is its incredible ease of use. New members of a team can immediately access advanced tools without the need for extensive training, allowing accounting and tax departments to quickly adapt to changes in resource planning. Whether you’re a seasoned accountant or tax professional, or someone just starting out in the field, Lucasys Depreciation can simplify the process of tracking depreciation and make your work more efficient.

Lucasys Depreciation Simplifies Fixed Asset Tracking for Utilities

Lucasys Depreciation was designed to streamline depreciation for utilities, with advanced reporting and dashboard functionality that make it easier for financial and tax teams to stay compliant while saving time and effort. Calculating and tracking fixed asset depreciation can be a complicated and time-consuming process, especially for rate-regulated utilities. Large quantities of assets and strict accounting regulations add complexity to what should be a straight-forward process. Whether you're a finance professional, tax professional, or someone interested in learning more about how technology can simplify complex financial processes, Lucasys Depreciation has the answers.

IRS Issues New Safe Harbor Rules for Natural Gas Repairs: What Rate-Regulated Utilities Need to Know

The IRS has issued a new revenue procedure, Rev. Proc. 2023-15, providing a safe harbor method of accounting for natural gas transmission and distribution property repairs, maintenance, replacements, and improvements. This new method allows taxpayers to classify these costs as either capital or deductible expenditures, providing clear and bright-line rules to reduce the burden of compliance.

Lucasys Deferred Tax Empowers Utilities with Dynamic Excess Reversal Controls

Lucasys Deferred Tax has modernized the management of deferred tax reversals by building a suite of intuitive and dynamic controls to streamline their management. Deferred tax balances and associated excess is tracked at a granular level to allow for complete calculation transparency, allowing for new insights into the accumulation and reversal of deferred balances.

Unmatched Reliability: Lucasys Sets the Standard for Industry Expertise and Technical Support

Lucasys provides peerless expertise in managing deferred tax assets for rate-regulated utilities and works closely with its customers to incorporate their feedback into product development.

Proposal to Increase the Corporate Tax Rate... Again!

In late March 2023, President Biden proposed a federal budget for fiscal year 2024 that will increase government spending in new infrastructure, education, healthcare, and climate change initiatives. To fund the investments, the Biden administration has proposed several tax reforms that will have important implications for corporations. Specifically, the proposed increase in the corporate income tax rate from 21% to 28% will have a significant impact on rate-regulated utilities

IRS Rules Salvage is Protected, Cost of Removal is Not

On October 15, the IRS issued PLR 202141001 for regulated electric utilities. In its ruling, the IRS reiterated earlier assertions that the net deferred tax asset (DTA) related to the cost of removal (COR) is not subject to normalization, but also added clarification that the deferred tax liability (DTL) and DTA from the salvage value is subject to normalization rules.

Details Emerge on Democrats’ Corporate Tax Rate Increase Proposals

Specifics for the “Build Back Better“ (BBB) reconciliation legislation have finally begun to emerge amid contentious intra-party debates within the Democratic caucus. The massive bill encompasses large portions of the Biden domestic political agenda, and debate is ongoing in Congress on the final scope of the bill and how its initiatives will be paid for.

Smart Meter Market Trends

Smart meters are an important technology for the modern electric power industry and are revolutionizing the way customers interface with energy grids. By enabling rapid two-way communications between electric companies and their customers, smart meters provide new and expanded services and enhance energy grid resiliency and operations.

TBBS: an Increasingly Important Internal Control

Tax basis balance sheets (“TBBS”) are a foundational part of any tax department’s controls. While invaluable for supporting tax positions for financial reporting, without proper maintenance these critical workpapers can quickly develop inaccuracies. More and more utilities are finding that their tax basis balance sheet controls are insufficient, and without proper automation, this can lead to an immense and recurring manual effort for tax departments looking to preserve reliable tax accounting records.

Dueling Proposals: Which Plan Will Transform America's Infrastructure?

In March, the Biden administration unveiled a $2.3 trillion infrastructure plan which included many proposals that specifically target the energy industry, including expanded renewable energy tax credits, mandates for utility system modernization, and transitioning the power sector to emissions-free electricity by 2035. Congressional Republicans responded by releasing a $568 billion counter-proposal which included a more limited scope of what qualifies as infrastructure. Since that time Biden has offered to cut his plan to $1.7 trillion, and Republicans have countered again with second counter-proposal of $928B.

What Is a kWh Anyway?

The average consumer notices their power consumption two times: when their lights go out and when they are paying their bill. The rest of the time, electric customers generally do not think about the role electricity plays in their day-to-day life or just how much electricity they use on any given day.

Part of the reason that power consumption is not thought about much is that it can be difficult to conceptualize, especially given some of the unique terminology. To help understand power consumption, the following infographics provide a comparative analysis of electricity use.