Corporate Tax Rate Changes Are on The Horizon: What Utilities Need to Know

When the US federal corporate tax rate changed from 35 to 21 percent, many rate-regulated utilities discovered that their tax accounting systems were ill-prepared to handle the ramifications of the rate change. Now, with the possibility of two pivotal political scenarios looming in the near future, the prospect of impending shifts in corporate tax rates has once again captured the attention of utility executives and financial experts alike. With rate changes on the horizon once again, utilities must understand the potential impact the change will have on their tax computations, drawing lessons from past experiences to prepare for an uncertain future. As we stand on the precipice of change, two key variables loom large: the outcome of the next U.S. presidential election and the composition of the House of Representatives.

A Potential Rate Decrease: Implications of a Trump Presidency

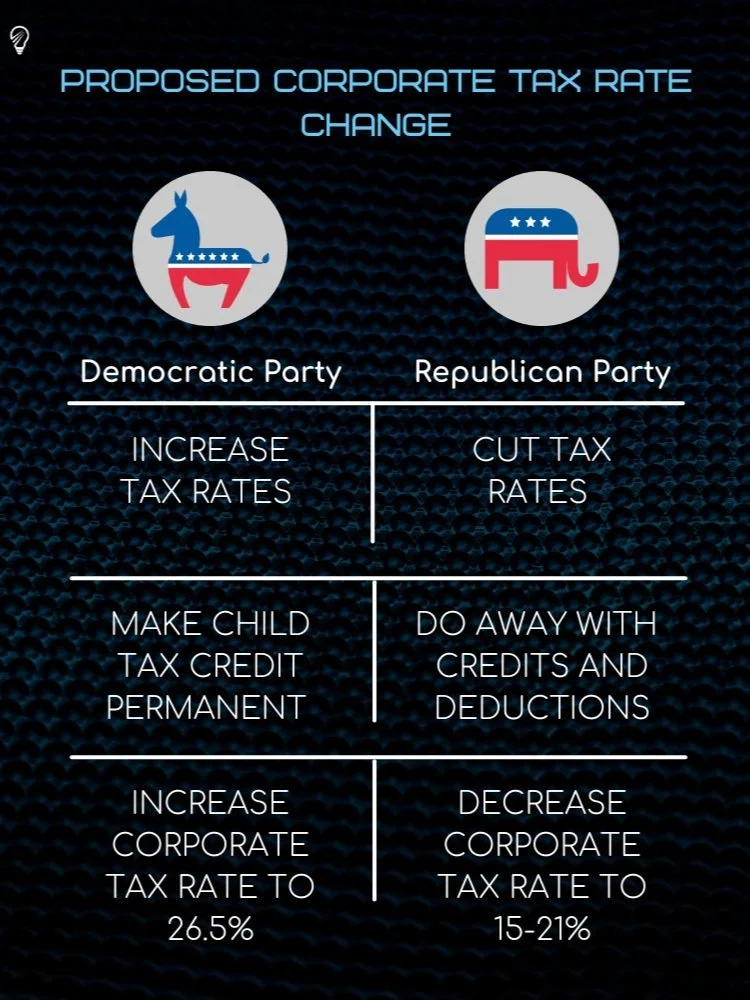

Earlier this week, White House economics reporter Jeff Stein published a story reporting that former president Donald Trump’s economic advisers are plotting an aggressive new set of tax cuts to push if he wins a second term in the Oval Office. Trump and his advisors reportedly seek to expand on the administration’s cut in tax rates from the 2017 Tax Cuts and Jobs Act, revising the corporate tax rate to as low as 15 percent

“There’s a lot of conversation right now about what the next tax priorities of a potential Trump administration should be, including lower rates — which he clearly wants to do ,” said economist Arthur Laffer, a Trump adviser.

“The idea I’ve been talking about with Trump is: Why don’t we go to 15 percent corporate rate, get rid of the credits and deductions, and just make it 15 percent,” said Stephen Moore, outside economic adviser to Trump.

Donald Trump’s 2016 tax plan had targeted a 15 percent corporate tax rate, but a portion of congressional Republicans pushed back on the number before the party settled on 21 percent. It is not clear if congress will have an appetite to reduce rates further, but one thing is clear: Donald Trump has not forgotten his goal of a 15 percent tax rate and is likely to pursue it in a second Trump administration.

A Potential Rate Increase: The Impact of a Democratic House Majority

On the other side of the political spectrum, there is a very real possibility of an increase to the corporate tax rate if the Democratic party secures a majority in the House of Representatives. Currently, the Republican majority in the House is razor-thin, and the upcoming congressional redistricting in states like New York, Georgia, Louisiana, Mississippi and Alabama are likely to favor Democrats, potentially tipping the balance of power in their favor. This shift in the House composition would open the door to a reevaluation of corporate tax policies, and Democrats are likely to advocate for higher rates as a means of funding their ambitious legislative agenda.

Earlier in the Biden administration when Democrats controlled the presidency and both chambers of Congress, the party made their intentions clear regarding corporate tax rates. At the time several tax increases had been proposed in an effort to fund various initiatives, and in recent weeks the party has not been shy about showcasing their plans for new projects such as making the child tax credit permanent. With the potential for a House majority, Democrats could have the political leverage they need to push through these tax changes. The looming potential for tax rate increases will force corporations to closely monitor these developments and prepare for the possibility of increased tax burdens.

Strategies for Preparedness: Navigating Potential Tax Rate Changes

As the landscape of corporate tax rates remains uncertain, one thing is crystal clear: utilities must be prepared to adapt swiftly when change inevitably arrives. The timing and specifics of these rate adjustments may be hazy, but one proactive step utilities can take is investing in modern tax software that offers flexibility and functionality.

Adaptable tax software can empower tax departments to adjust their computations quickly and efficiently in response to evolving tax regulations, ensuring compliance and accurate financial reporting in a dynamic tax environment.

The Lucasys software suite remains the leader-in-class for utilities looking to empower their tax departments.

Lucasys Deferred Tax is unique in the industry because it was designed to provide utilities with the means to effectively manage their regulatory assets and liabilities, offering a clear and simplified approach with intuitive interfaces.

Because Lucasys Deferred Tax tracks rate changes in separate layers the impact of each rate change event can be isolated, making it easy to review progressive changes and to forecast future rate changes with either ARAM or RSGM methodologies.

In a time when tax compliance and optimization are paramount, having a tool like Lucasys Deferred Tax in their arsenal can be a crucial advantage for utilities, allowing them to stay ahead of the curve and navigate tax rate changes with confidence.

How Lucasys Can Help

Master uncertainty by leveraging industry-leading solutions with Lucasys. Whether looking for new software or trying to get the most value out of existing solutions, Lucasys can provide insights into the latest accounting and tax issues facing the utility industry. To learn more about how Lucasys can help visit https://www.lucasys.com/solutions.