Lucasys Blog

Preparing for Regulatory Scrutiny: Tax Compliance in the Utility Sector

In today’s rapidly evolving regulatory landscape, investor-owned utilities (IOUs) face increasing pressure to ensure their tax practices are not only compliant but also transparent and defensible. With the growing scrutiny from regulators and the ever-changing tax laws, staying ahead of potential audits is more critical than ever. To navigate these challenges, IOUs must implement robust strategies for tax compliance, leveraging advanced tools and technologies that can simplify the process and mitigate risks.

Understanding the Tax Implications of Mergers and Acquisitions in the Utility Sector

Mergers and acquisitions (M&A) have long been a strategic tool for growth and expansion in the utility industry. Whether to achieve economies of scale, expand service territories, or diversify energy portfolios, these transactions can significantly reshape a company's operations and market position. However, along with the potential benefits, M&A activities come with complex tax implications that can have a lasting impact on a company's financial health and regulatory compliance.

Navigating Tax Challenges in a Multi-Jurisdictional Utility Operation

For investor-owned utility companies operating across multiple states, managing tax compliance is a complex and often daunting task. Each state has its own set of tax laws, regulations, and reporting requirements, which can create a labyrinth of obligations for utility tax departments. In this environment, staying compliant while optimizing tax positions requires not only deep expertise but also the right tools and technology.

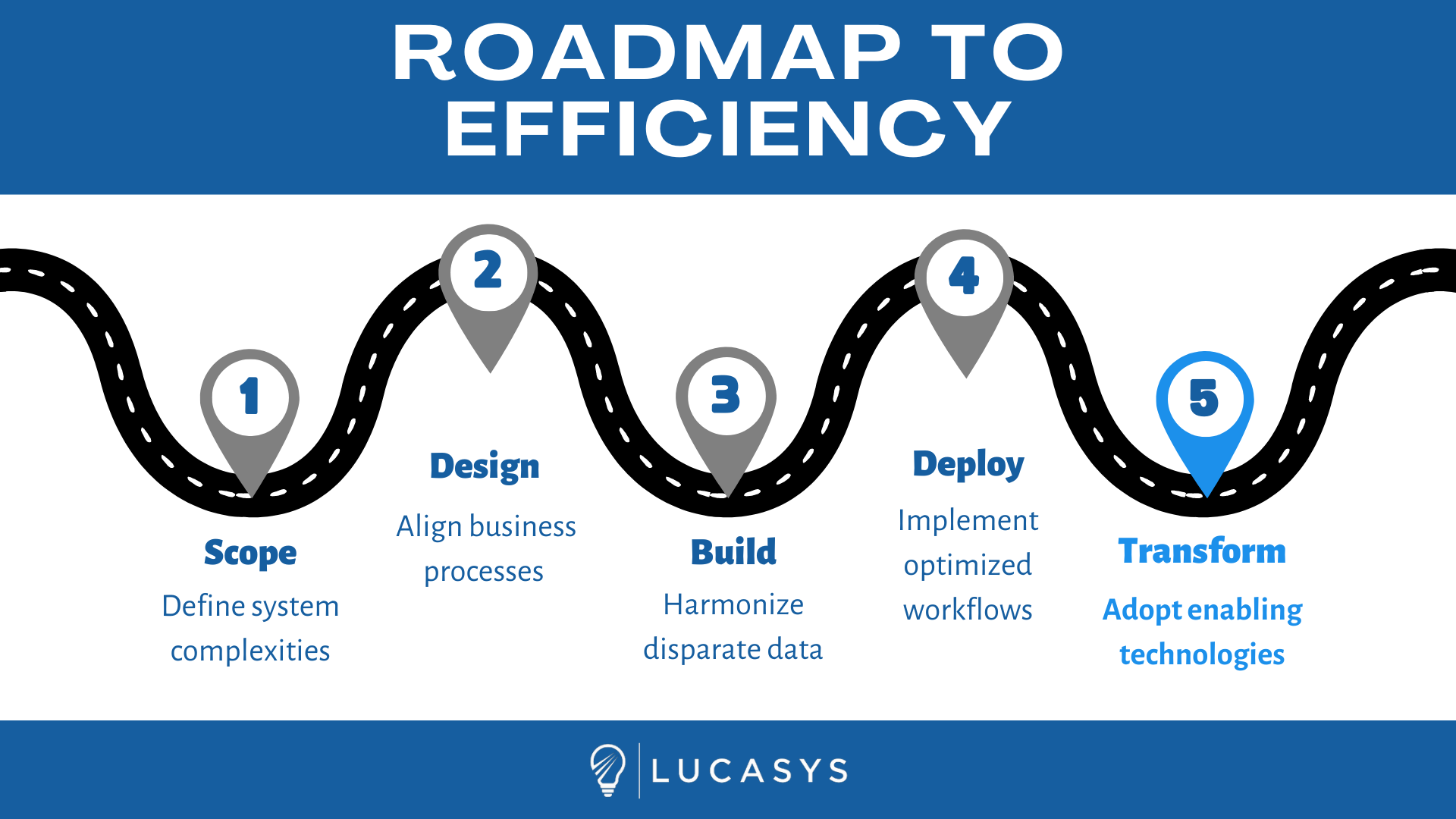

Lucasys Completes Two Phases in AEP’s Tax Technology Transformation, Building on Past Successes with Lucasys-led Solutions

Lucasys has successfully completed Phases 1 and 2 of American Electric Power’s (AEP) ongoing tax technology transformation initiative in partnership with Lucasys, a leading software and consulting firm specializing in the utility sector. These milestones mark significant progress in AEP’s journey toward modernizing and optimizing their tax function to manage the complexities of their dynamic operations.

Navigating the PowerTax End of Life: What Utilities Need to Know and How to Transition Smoothly to Lucasys Tax

As a utility company, you rely on robust, reliable software to manage complex tax processes efficiently. For decades, PowerPlan’s PowerTax software has been the only available industry-focused tax fixed asset solution. However, the Lucasys team has heard from many utilities that PowerPlan has communicated an End of Life for its PowerTax software. If your organization has been told that PowerTax is reaching its End of Life, you may now be facing the urgent task of finding a new solution to replace your legacy solution. The discontinuation of any software poses significant challenges, but it also presents an opportunity to upgrade to more advanced, future-proof technology like Lucasys Tax.

Strengthening Infrastructure for Resilience: The Crucial Role of Tax Software in Investor-Owned Utility Companies

As climate change accelerates, extreme weather events are becoming increasingly common, posing significant challenges to utility companies across the globe. Investor-owned utilities (IOUs), responsible for providing essential services to millions, are at the forefront of efforts to strengthen infrastructure and ensure resilience against these threats. While physical upgrades and operational strategies are crucial, one often-overlooked aspect of this resilience is the role of a utility’s tax division and its technology. Robust tax management is vital in funding, maintaining, and expanding resilient infrastructure.

Corporate Tax Rate Changes on the Horizon… Again! What Utilities Need to Know

As the 2024 election season gains momentum, regulated utilities are facing the prospect of significant policy shifts that could dramatically impact their financial landscapes. Vice President Kamala Harris has recently announced that if elected, she plans to raise the corporate tax rate to 28%. This proposal has raised alarms among tax leaders and CFOs within the utility sector, as the potential changes could lead to substantial adjustments in deferred tax liabilities.

Innovation in Tax Fixed Assets: Hope Utilities Adopts Best-in-Class Lucasys Software

Leading natural gas and water distribution services company, Hope Utilities, has implemented Lucasys’ industry-leading tax fixed asset software. Faced with the challenges of maintaining legacy software systems, Hope Utilities recognized the opportunity to streamline their accounting solutions and transform their business processes.

AEP's Data Revolution: Partnering with Lucasys to Prepare for the Next Leap in Tax Technology

American Electric Power (AEP), one of the nation’s largest utility power producers and operator of the nation’s largest electric transmission network, has a longstanding reputation as an industry leader in digital transformation and technological innovation. Successful operations have led AEP to sustained growth, expanding the organization into additional states and service territories while accumulating a blend of data, processes, and technologies.

Summit Utilities Partners with Lucasys to Streamline Tax Fixed Assets

In a pivotal move towards operational efficiency and advanced technology adoption, leading natural gas company Summit Utilities has embarked on a transformative endeavor with premier software and consulting firm Lucasys to revolutionize their tax fixed asset software.

Emerging Cybersecurity Threats: How Utilities Can Prepare

In today's increasingly interconnected world, the threat landscape for US utilities is evolving at an unprecedented pace. As these vital organizations continue to embrace digital technologies to improve efficiency and customer service, they also find themselves in the crosshairs of malicious actors seeking to exploit vulnerabilities. The realm of cybersecurity is fraught with challenges, and understanding the latest threats is essential for safeguarding critical infrastructure.

Corporate Tax Rate Changes Are on The Horizon: What Utilities Need to Know

As the landscape of corporate tax rates remains uncertain, one thing is crystal clear: utilities must be prepared to adapt swiftly when change inevitably arrives. The timing and specifics of these rate adjustments may be hazy, but one proactive step utilities can take is investing in modern tax software that offers flexibility and functionality. Adaptable tax software can empower tax departments to adjust their computations quickly and efficiently in response to evolving tax regulations, ensuring compliance and accurate financial reporting in a dynamic tax environment.

Empowering Modern Utilities: The Essential Investment in High-Performance Accounting Software

In an era where technological advancements are reshaping industries and redefining the very essence of efficiency, utilities find themselves at a crucial crossroads. Ever-growing demand for reliable energy services has placed an enormous burden on rate-regulated utilities to streamline their operations and optimize every facet of their business. However, many utilities continue to rely on outdated accounting systems and processes that limit their ability to adapt to an evolving landscape. Investment in high-performance computing is becoming critical for operational success, and utilities need a viable plan for transitioning to the best available accounting technology in order to drive sustainable growth in a competitive market.

Navigating the Age Wave: The Maturing Workforce in the Utility Industry

A significant trend has emerged in the utility landscape that demands attention and adaptation: the age of its workforce. The average age of employees in the industry consistently surpasses the national average. As veteran workers approach retirement, rate-regulated utilities are being prompted with both challenges and opportunities. As utilities confront their own business processes and explore the next generation of software solutions, Lucasys stands as an industry leader.

Lucasys Depreciation Simplifies Fixed Asset Tracking for Utilities

Lucasys Depreciation was designed to streamline depreciation for utilities, with advanced reporting and dashboard functionality that make it easier for financial and tax teams to stay compliant while saving time and effort. Calculating and tracking fixed asset depreciation can be a complicated and time-consuming process, especially for rate-regulated utilities. Large quantities of assets and strict accounting regulations add complexity to what should be a straight-forward process. Whether you're a finance professional, tax professional, or someone interested in learning more about how technology can simplify complex financial processes, Lucasys Depreciation has the answers.

Lucasys Deferred Tax Empowers Utilities with Dynamic Excess Reversal Controls

Lucasys Deferred Tax has modernized the management of deferred tax reversals by building a suite of intuitive and dynamic controls to streamline their management. Deferred tax balances and associated excess is tracked at a granular level to allow for complete calculation transparency, allowing for new insights into the accumulation and reversal of deferred balances.

Maximizing Your Returns: Lucasys Deferred Tax Helps You Navigate Excess Deferred Income Taxes

Introducing Lucasys Deferred Tax: a first-of-its kind software designed for rate-regulated utilities that provides comprehensive tracking of excess deferred taxes. This innovative software solution enables utilities to track complex tax and regulatory accounting requirements with ease, ensuring compliance with regulatory requirements and accurate reporting of tax balances.

Proposal to Increase the Corporate Tax Rate... Again!

In late March 2023, President Biden proposed a federal budget for fiscal year 2024 that will increase government spending in new infrastructure, education, healthcare, and climate change initiatives. To fund the investments, the Biden administration has proposed several tax reforms that will have important implications for corporations. Specifically, the proposed increase in the corporate income tax rate from 21% to 28% will have a significant impact on rate-regulated utilities

Digital Technologies Propel Utilities to Transform Workforce

Utilities are bracing for a digital revolution, though according to a recent report most executives in the sector agree that their businesses are not prepared for it.

In the Digital Transformation and the Workforce Survey commissioned by EY Power & Utilities, nearly 90% of executives report having too few digitally savvy workers is frustrating their ability to adopt digital technologies. Not only is the problem of an insufficient workforce staring them in the face, by most of the respondents surveyed are lacking a plan on how to proceed. With near-universal agreement (94%) on the need for direct investment in technology and the workforce, utilities are soon to be left scrambling for solutions. The transformation of the power industry will be based on technology, but it will be driven by people.

TBBS: an Increasingly Important Internal Control

Tax basis balance sheets (“TBBS”) are a foundational part of any tax department’s controls. While invaluable for supporting tax positions for financial reporting, without proper maintenance these critical workpapers can quickly develop inaccuracies. More and more utilities are finding that their tax basis balance sheet controls are insufficient, and without proper automation, this can lead to an immense and recurring manual effort for tax departments looking to preserve reliable tax accounting records.