Maximizing Your Returns: Lucasys Deferred Tax Helps You Navigate Excess Deferred Income Taxes

For rate-regulated utilities, navigating excess deferred income taxes is a complex and challenging task. The potential financial benefits of optimizing deferred tax balances can be significant but doing so requires a deep understanding of the regulatory landscape and the ability to analyze large volumes of financial data. To manage their excess deferred tax balances, more and more utilities are turning to Lucasys. By providing real-time insights into a utility's deferred tax balances, Lucasys software solutions allow finance teams to identify potential overpayments or underpayments and optimize their tax positions.

Managing Excess Deferred Income Taxes

To manage the complex tax and regulatory accounting requirements related to excess deferred income taxes, utilities must have an accurate and efficient system in place to track and analyze deferred tax balances and regulatory assets and liabilities. These systems must ensure they are complying with regulatory requirements and that their deferred tax balances are being reported correctly. In addition, utilities must ensure that they are forecasting correctly so they can plan ahead and make informed decisions about the reversal of excess balances. Failure to comply with regulatory requirements can result in significant financial penalties, reputational damage, and potential legal liability. Incorrect reversal of excess deferred taxes can have a significant impact on a utility's financial statements.

Lucasys Deferred Tax: The New Standard

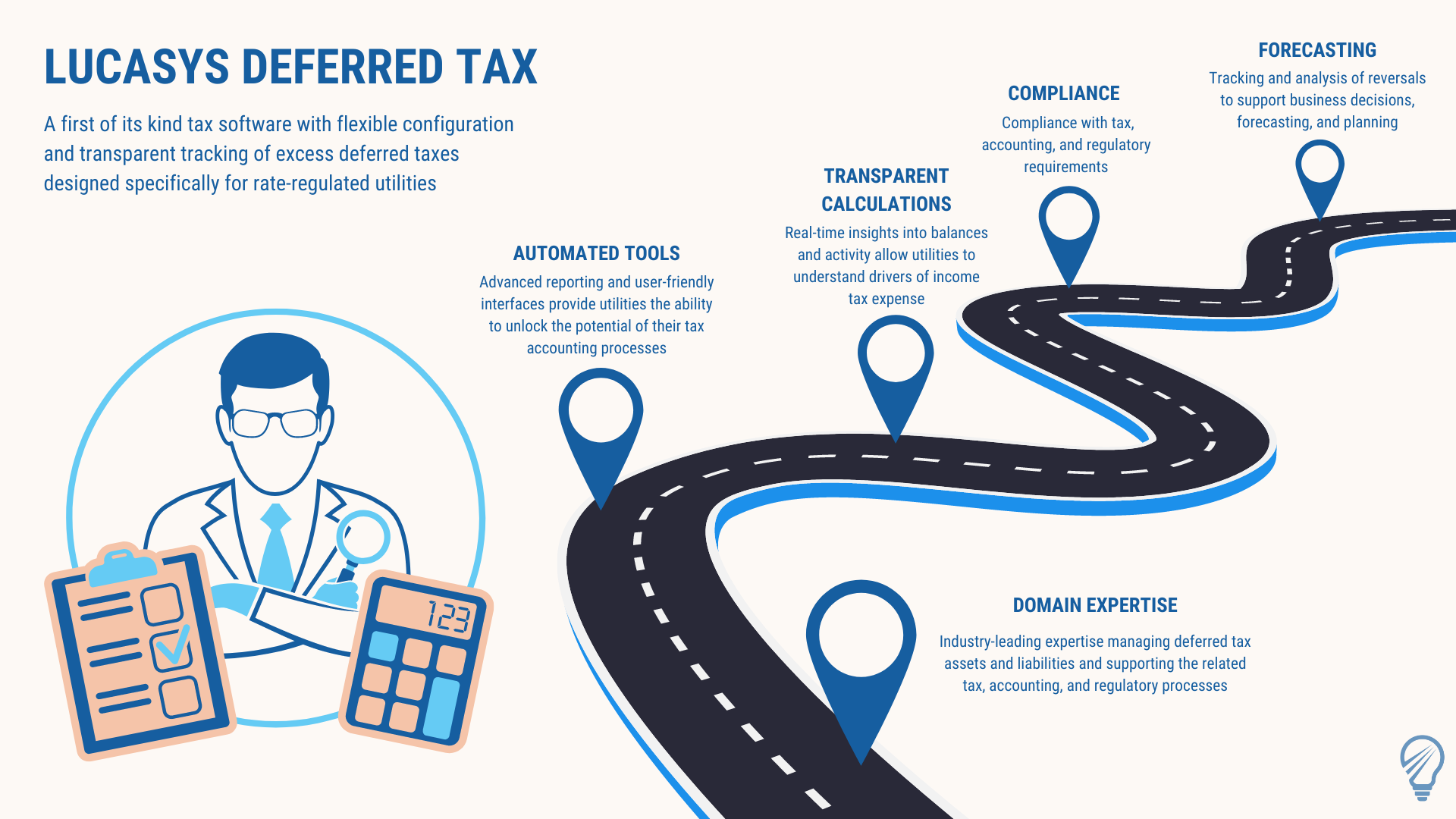

Introducing Lucasys Deferred Tax: a first-of-its kind software designed for rate-regulated utilities that provides comprehensive tracking of excess deferred taxes. This innovative software solution enables utilities to track complex tax and regulatory accounting requirements with ease, ensuring compliance with regulatory requirements and accurate reporting of tax balances.

Lucasys Deferred Tax is specifically designed for rate-regulated utilities, providing unparalleled accuracy and efficiency in tracking deferred tax balances and regulatory assets and liabilities. No similar software solution currently exists in the marketplace, making it a game-changer for utilities looking to streamline their tax accounting processes. Advanced reporting functionality and user-friendly interfaces provide utilities with greater visibility and control over their deferred tax balances, enabling them to make informed decisions and achieve greater efficiency with intuitive and automated tools. With Lucasys Deferred Tax, rate-regulated utilities can unlock the full potential of their tax accounting processes and stay ahead of evolving regulatory and legislative requirements.

The Cutting Edge of Tax Technology

Lucasys Deferred Tax has revolutionized the tracking of excess deferred income taxes by giving users the ability to view and manage excess deferred taxes separately for each rate-change event. By allowing utilities to track unique “rate-change layers”, customers can now view the excess deferred taxes associated with each rate change by jurisdiction.

In addition, automatic tracking of protected vs unprotected temporary differences and accumulated deferred income taxes allows utilities to communicate more effectively with regulators and other stakeholders. Native functionality allows for increased efficiency and reduced risk of errors, allowing for streamlined compliance.

New advanced reporting functionality simplifies the visualization and summary of reversing excess deferred taxes. Lucasys Deferred Tax features robust systems to accurately track and analyze deferred tax balances and regulatory assets and liabilities, while providing accurate forecasting and scenario analysis. With Lucasys Deferred Tax, utilities can ensure compliance with regulatory requirements, maximize financial returns, and achieve greater efficiency in managing their tax balances.

How to Learn More

Master uncertainty by leveraging industry-leading modeling solutions with Lucasys. Whether looking for new software or trying to get the most value out of existing solutions, Lucasys can provide insights into the latest tax issues of the utility industry. To learn more about how Lucasys can help, visit https://www.lucasys.com/deferred-tax-solutions.

Lucasys software solutions allow finance teams to identify potential overpayments or underpayments and optimize their tax positions.